With three-quarters of 2023 in the books, I can confidently say that we have not seen a market quite like this in Park City. It is a peculiar mix of data points that paints a picture about as clear as milk. Inventory remains incredibly constrained, transactions are significantly reduced, and pricing on a general basis continues to rise. There is a growing divide between not only our residential and resort/investment marketplaces but also new/renovated properties and ones that are functionally obsolete, creating a bifurcated market.

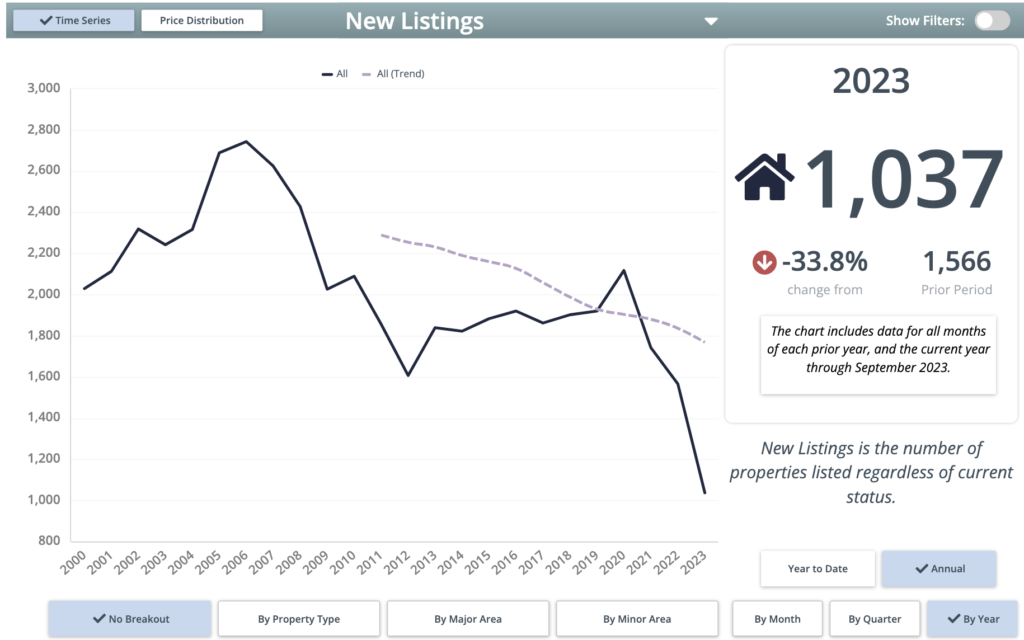

Active inventory right now is 40% below our pre-covid averages. Compared to 2022, we are 50% below on the year so far. We have had 33.8% fewer new listings this year than in 2022; if we maintain that trend, it will be the lowest number of properties to be listed since we started tracking statistics, illustrated below. This creates a dynamic marketplace, where certain properties are highly competitive and will generate multiple offers, and others will sit and accrue days on market.

Impact of Interest Rates

The correlation between rising interest rates and a decrease in home sales is significant. That was the goal of the Federal Reserve. Of course, people who purchased in the last two years and those who re-financed hold mortgages with sub-3 % rates they don’t want to let go of. The result is fewer homes for sale, which means less options for potential sellers to trade into.

This feedback loop has resulted in an immense lack of inventory, as enticing properties that are priced well, are buttoned up and in good condition, sell. The properties left behind create a stagnant segment of standing inventory. Usually I like to display the median price in our market, but based on the amount of sales and the data set available I don’t believe the median price for Q3 is reflective of what we are actually seeing in the marketplace.

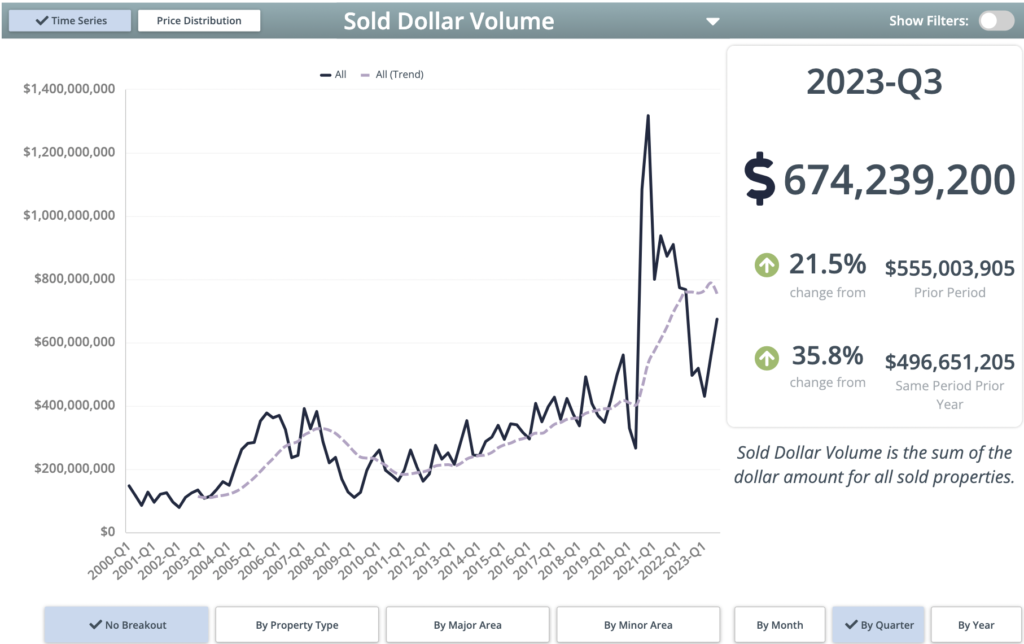

From a median price perspective, we have had four consecutive quarters of growth with a 10% increase year-over-year. The median price continues to push up because of the strength of the resort marketplace, particularly on the high end. There are seven properties which account for about $110m in sold dollar volume. This translates into 2.7% of sold properties accounting for 16.3% of the total volume for the quarter.

Total Closed Sales are Down Significantly

Does this mean that the market isn’t strong? Not necessarily. The market may be a bit more challenging to navigate, and we may need to readjust our expectations. Properties are not selling in a day, but there are still buyers and sellers out there. I was one of those people who bought and sold in this market.

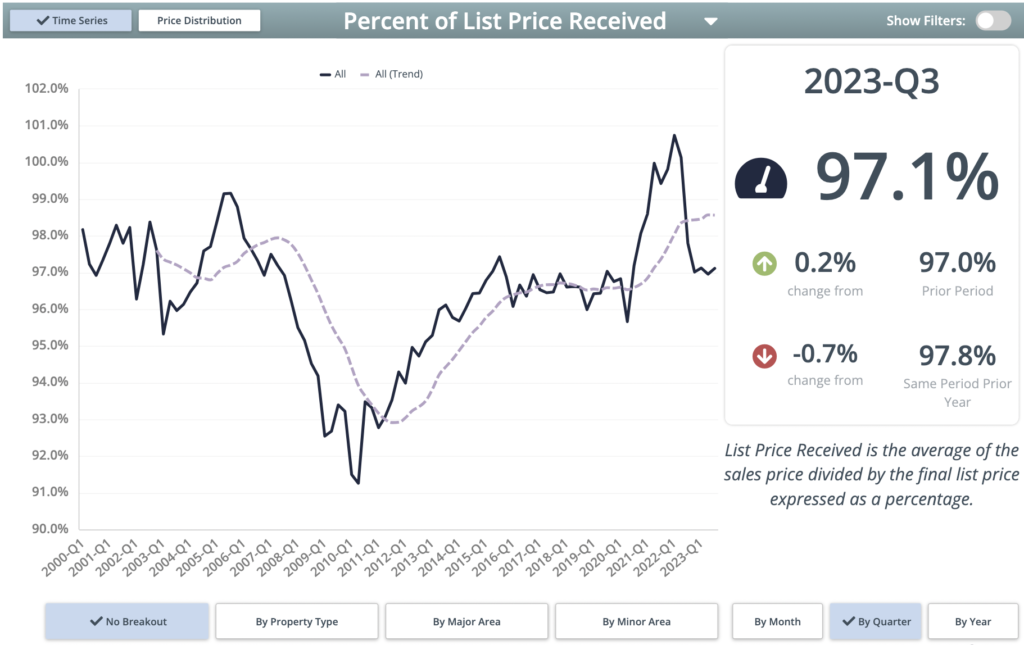

Today’s successful seller must offer a home priced in line with supporting data and present a well maintained and visually beautiful home. Getting the initial list price right for the property’s location and condition is essential. We are seeing an average of 97.1% sale to list price ratio. The statistics show that getting the initial list price right will sell in an average of three weeks and at about 98% of list price. Properties that require a list price adjustment on average are selling for about 88% of that initial list price, meaning a large price reduction, and taking significantly more time, about 4 months, to sell.

If you are buying in this market, it is imperative to understand and know what you are looking for in a property. As I mentioned above, in this bifurcated marketplace if you are looking for a fixer-upper type property you haven’t had this much leverage in several years. However, if you want a property that is ready to move into, and that is priced well it can be a very competitive marketplace, sometimes with multiple offers. More importantly though, knowing what you want is incredibly valuable as we can go into our network of sellers and agents and try to identify a property for you before it comes to market.

Based on a recent report from UBS – who is notoriously conservative in projections – and the Case-Shiller Index, we can see that in general, home prices have been on the rise, and are expected to increase. We cannot say for sure what will happen, but given the economic conditions and limited inventory, it doesn’t appear that there will be any respite when it comes to pricing. Further, with the lack of inventory, it is imperative that buyers are ready to pull the trigger, by either being pre-approved, or providing verification of funds.

Over half (50.8%) of the 651 sold properties year to date were purchased with cash. This is in line with historic averages. In an economic marketplace where folks could park their money in a savings account and earn a guaranteed 5-6% return, they chose to purchase property in Park City. There is a lot of belief in the long-term appreciation in our town, and as a tangible asset, you would be hard-pressed to find another that could provide such a high quality of life. The sold dollar volume for Q3 illustrates how active the top of our market is.

Although hit with supply-side constraints, Park City and Utah’s long-term outlook is positive. Growth in the state population and continued investment into new and existing industries will continue to fuel the buyers entering our marketplace. In addition, with the expansion of Deer Valley, Park City gives skiers the choice of two of North America’s largest ski resorts, with another five world-class resorts within 45 minutes. The options for world class skiing combined with Park City’s easy access to Salt Lake International Airport, create a unique niche in the American West. The Park City market remains robust even with challenging market conditions.

This article was written by my partner Justin Altman. He can be reached at 435-640-8681 or justin.altman@sothebysrealty.com.