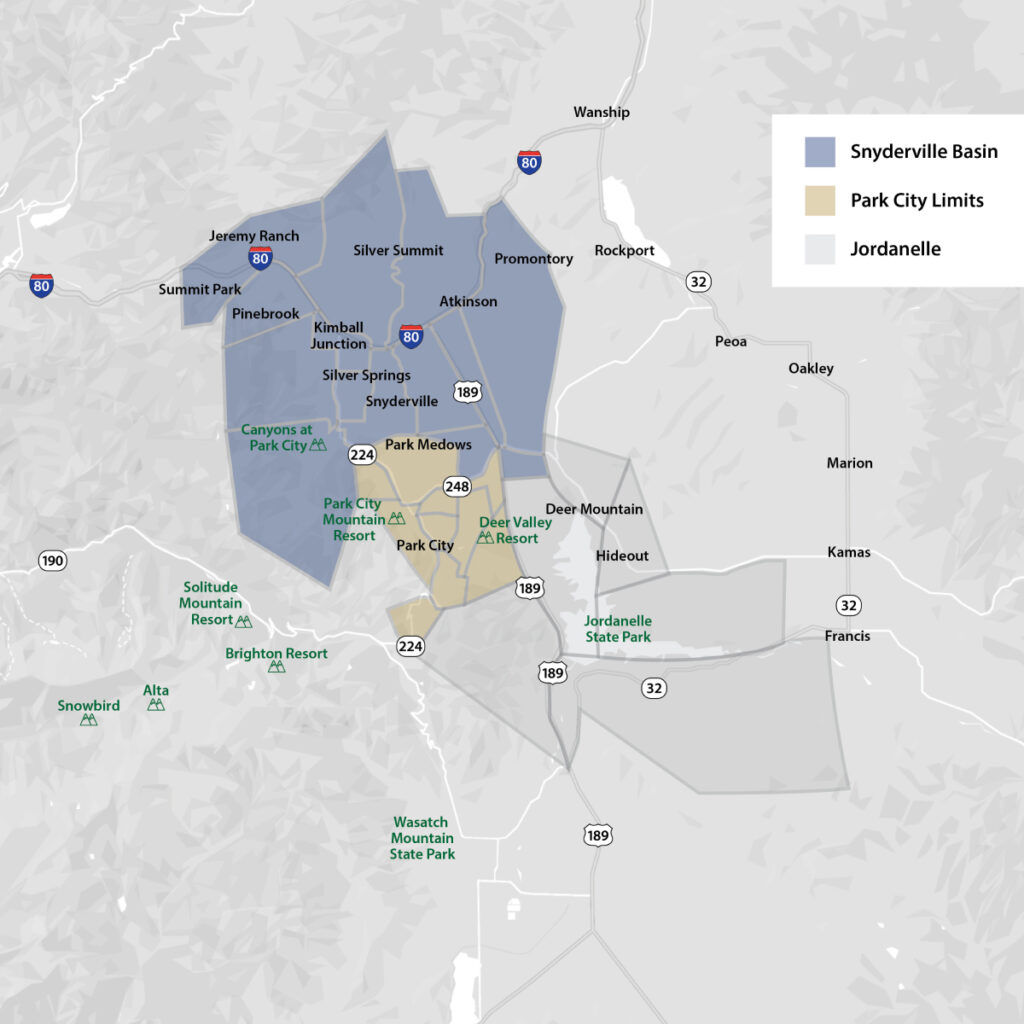

Park City Limits & Snyderville Basin – Single Family Homes, Condos & Townhomes

- Median Sales Price: $1.687m, Down 7.4% compared to last quarter

- Average Sales Price: $2.712m, Down 2.4% compared to last quarter

- Closed Sales: 175, Down 25.2% compared to last quarter

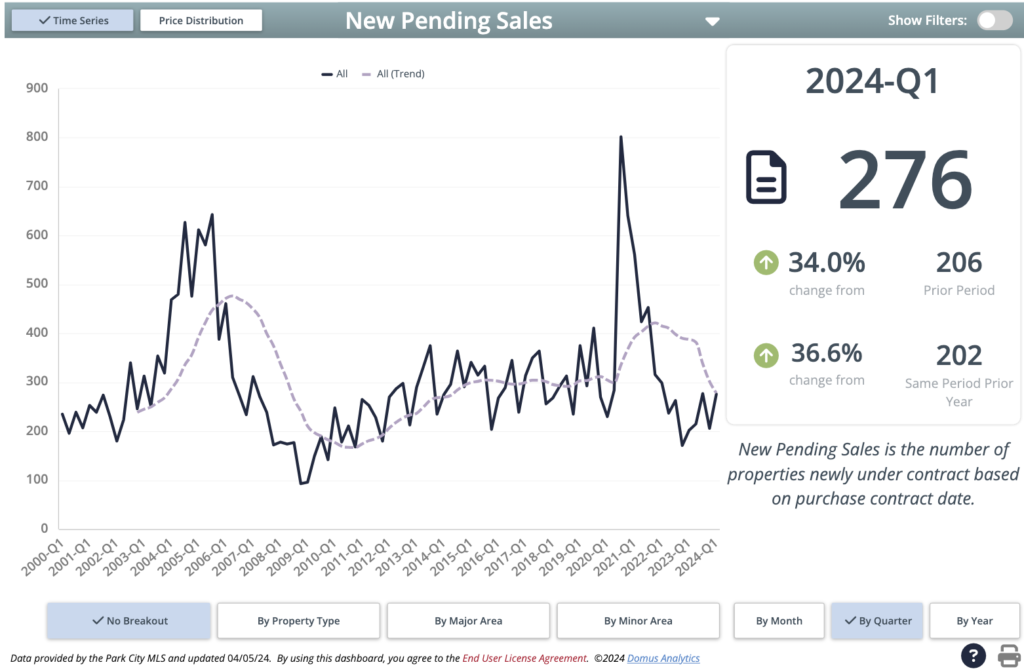

- Pended Sales: 276, Up 34% compared to last quarter and 36.6% compared to the same quarter last year

- Median Days On Market: 37

- Properties Listed This Period: 356

The overall Park City market saw a resurgence of activity in the first quarter of 2024. Driven by an equities market rally and optimism that 2024 will see rate cuts by the Federal Reserve, pended sales matched Q3 of 2023 (historically, the third quarter is our heaviest quarter for pended sales) and gave us the strongest start to the year since 2022 when the Covid market peaked.

Median and average sales prices were down marginally, though this is a bit misleading. In short, while single-family homes are setting new highs, a higher proportion of total sales occurred in the condo/townhome segment at lower prices, contributing to the decline in average and median prices.

Active inventory remains historically low; unless there is a significant increase in inventory over the coming quarters, there will be a new trendline set (which you can see beginning to develop in the chart above). That said, there was a nice pop of new listings this quarter, which helped ease the strong demand. It also indicates, in my opinion, that people who were previously holding onto low mortgage rates but in a property that didn’t fit their needs are now exploring the marketplace.

Anecdotally speaking, “move-up” buyers seem to be more active this year compared to last year. With the anticipation of rate decreases in the coming years and more seller financing available, people are finding solutions to their real estate needs.

Park City Limits & Snyderville Basin – Single-Family Homes Only

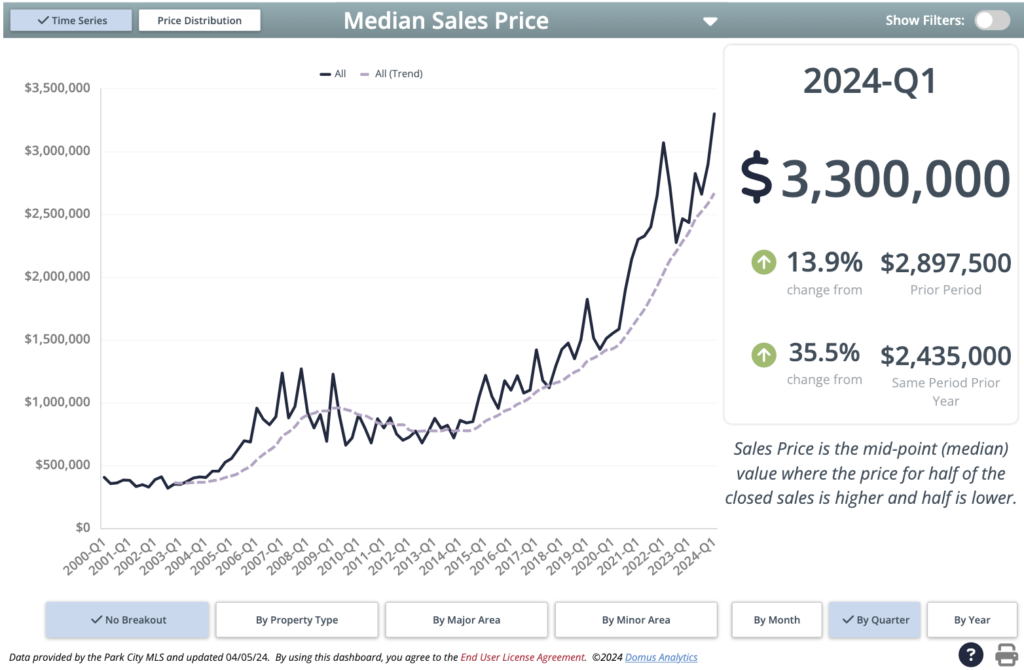

- Median Sales Price: $3.3m, Up 13.9% compared to last quarter and 35.5% compared to same quarter last year

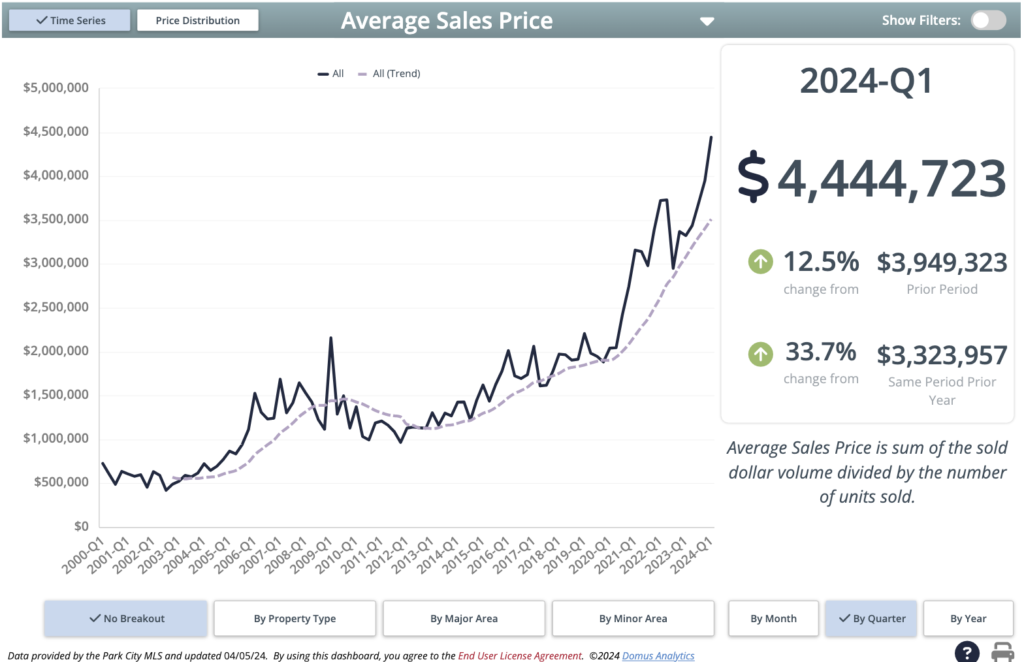

- Average Sales Price: $4.444m, Up 12.5% compared to last quarter and 33.7% compared to same quarter last year

- Closed Sales: 66, Down 42.1% compared to last quarter

- Pended Sales: 107, Up 28.9% compared to last quarter and the same quarter last year

- Median Days On Market: 83

- Properties Listed This Period: 126

Median Sale Prices in Park City & Snyderville Basin

Average Sale Prices in Park City & Snyderville Basin

There are some eye-popping numbers regarding the median and average sales prices in the greater Park City marketplace.

The dataset is a bit smaller, with only 66 closed sales, which were pretty top-heavy – a third of the sales were $5-15m! A majority of these luxury residences are located in Promontory, which for years has been one of the top-selling neighborhoods of Park City due to the contemporary design and new construction of their properties and phenomenal lifestyle amenities.

Like last year, the top end of the market has been incredibly active. Only two homes sold under $1m during the first part of the year, illustrating the significant price increase that has occurred in our real estate market over the last few years. That said, as more of the “primary residential” market opens up in Q2 & Q3, I anticipate these numbers will level out as the middle of the market becomes more active.

While closed sales are down heavily, that is not uncommon for Q1, with Q4 generally being the lowest quarter for pended sales. In my estimation, we saw the “bottom” of the market in October/November with pricing and properties going under contract hitting lows, contributing to the minimal closed sales volume we saw in Q1. Pended sales for single-family homes being this high in Q1 illustrates a pent-up demand for a market that took last year off.

Park City Limits & Snyderville Basin – Condos & Townhomes Only

- Median Sales Price: $1.17m, Down 1.7% compared to last quarter

- Average Sales Price: $1.679m, Up 0.8% compared to last quarter

- Closed Sales: 109, Down 9.2% compared to last quarter

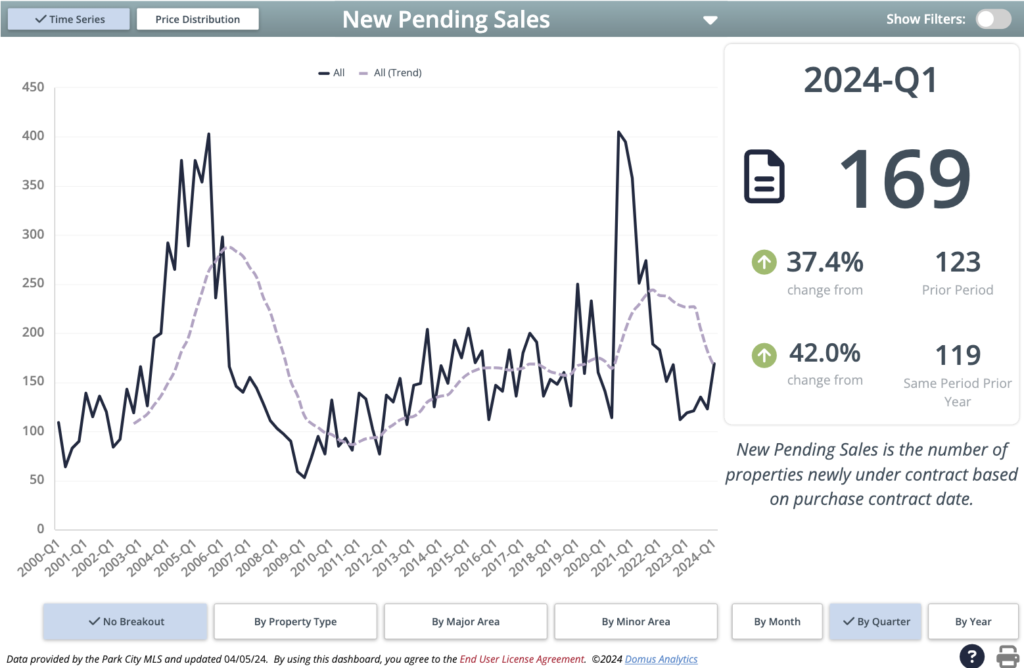

- Pended Sales: 169, Up 37.4% compared to last quarter and 42% compared to the same quarter last year

- Median Days On Market: 19

- Properties Listed This Period: 230

Condo & Townhome pended sales

Condo sales in the first quarter can be an interesting mix. Generally speaking, this property type is more prone to be in a short-term rental pool, so inventory levels tend to be lower, and sales can be all over the place. A perpetually rented property can be rather difficult to sell, and with ski season being the time of year to collect rental revenue, we see more sellers of this type of property in Q2 and Q3.

Pricing being static and closed sales being down are therefore not much of a surprise; that said, pended sales being as high as they are, shows people were ready to list their resort property and buyers were eager to snap them up.

The median days on market (DOM) demonstrates a real shortage of quality real estate in a good location. When these properties hit the market, it can be competitive! This property segment tends to carry a higher amount of cash buyers given some of the challenges that can come up with financing resort real estate, and the first quarter saw 59% of the properties purchased with cash. While cash is a great negotiating tool, in our marketplace it tends to be the rule, not the exception.

Greater Jordanelle – Single Family Homes, Condos & Townhomes

- Median Sales Price: $1.145m, Down 13.5% compared to last quarter

- Average Sales Price: $1.536m, Down 10% compared to last quarter

- Closed Sales: 91, Up 4.6% compared to last quarter

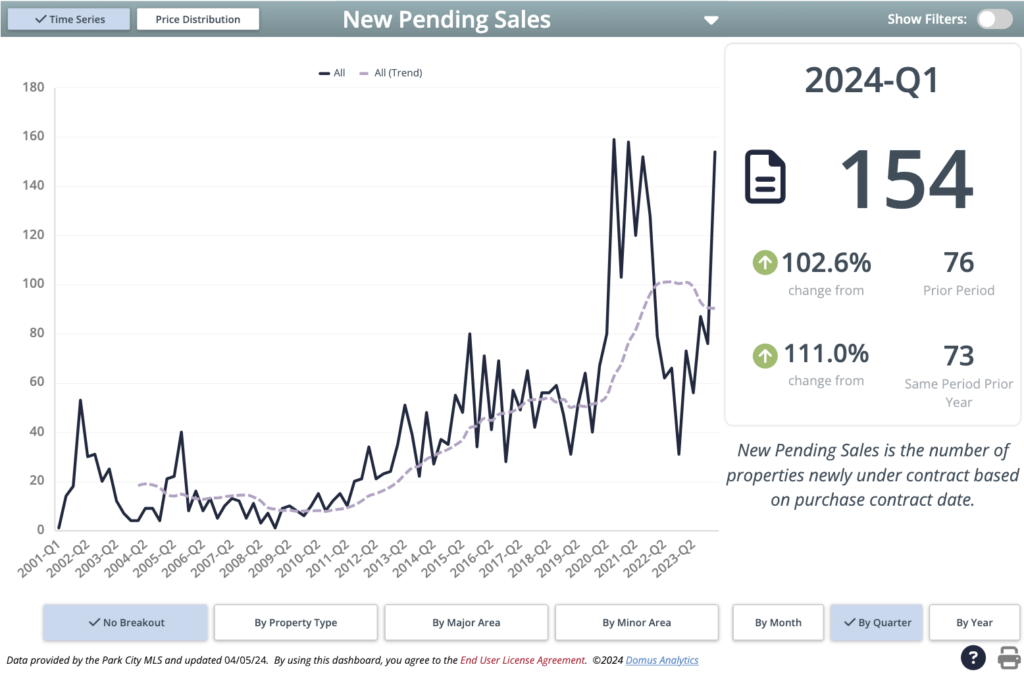

- Pended Sales: 154, Up 102.6% compared to last quarter and 111% compared to the same quarter last year

- Median Days On Market: 15

- Properties Listed This Period: 162

Jordanelle pended sales

Were you ever curious about Deer Valley’s brand power? Well, in the first quarter, Deer Valley announced their expansion and new base village by the Jordanelle known as “East Village,” and as the pended sales illustrate, people were furiously trying to get a piece!

A single project that has a significant impact on this dataset is called Pioche. First, Pioche is a fantastic opportunity. Consisting of studios, 1-bedroom, and 2-bedroom condos with ski access via the Jordanelle Gondola and parking, the combination of price and location is fantastic! A majority of the units are studios with pricing in the $400-500k range. Pioche significantly contributes to the uptick in pended sales and decreases in median and average sales prices.

Given the significant growth and future years of development around the Jordanelle, I thought it would be good to highlight what is happening. From Tuhaye to Pioche, a price point and real estate option is available around the water for everyone!

Have questions about a specific neighborhood or want to go into greater detail? Feel free to reach out!