This thorough roundup and analysis of Q1 2022 stats was prepared by our resident MLS guru, and my partner, Justin Altman. He can be reached at justin.altman@sothebysrealty.com.

Q1, 2022 Statistics & Analysis

The red hot housing market we experienced through 2021 continued its unrelenting march through the first quarter of 2022. Even though we experienced a slight increase in inventory by the end of Q1, we hardly approached a balanced market. Inventory constraints led to decreasing sales. However, the delta for sales dollar volume was marginal, with a 22% decrease in total sales but only a 7% decrease in sales volume courtesy of market appreciation.

It is important to note that the first part of this blog is a review of Q1. I included a status report of where we are in the midst of Q2, because we know that a market shift has occurred. In fact, I am slightly tardy with my analysis because I was waiting for relevant data from April to be digested to gain some insight.

Overall, Q1 2022 was an incredibly strong quarter given the inventory constraints. I look at Q1 2022 as an inflection point where the market shifted, and we begin to see more balance on the horizon.

Q3 & Q4 of 2020 represented the high points of sales volume within our market, and since then, each quarter has had a drop in total sales, primarily due to constrained inventory levels. In evaluating Q1 of 2022, we can see that many sales metrics have returned to pre-covid numbers, particularly sales volume.

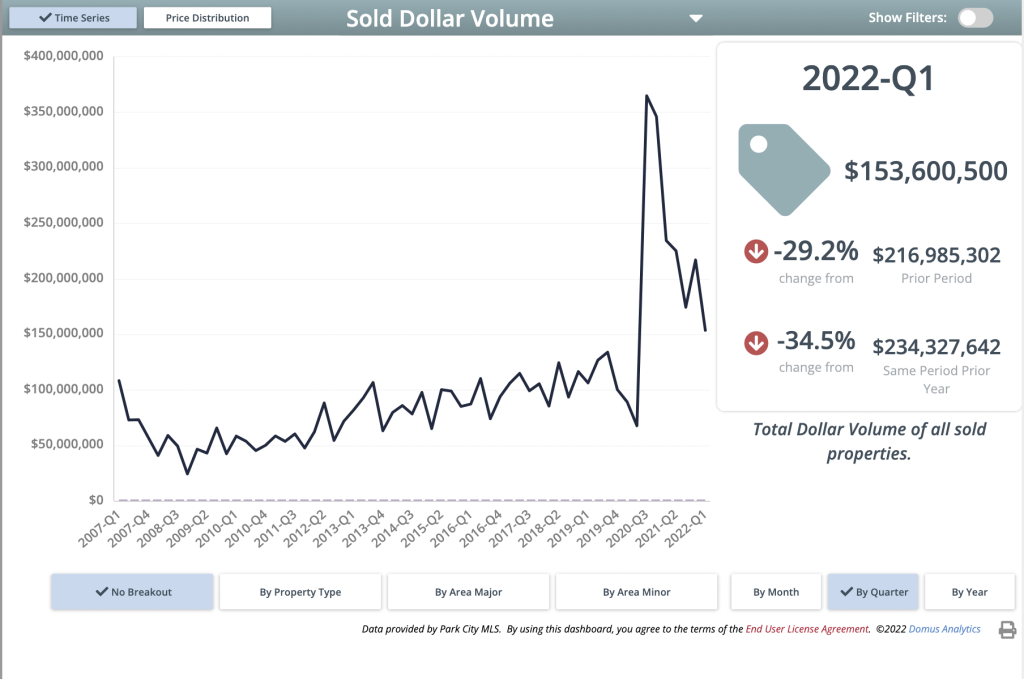

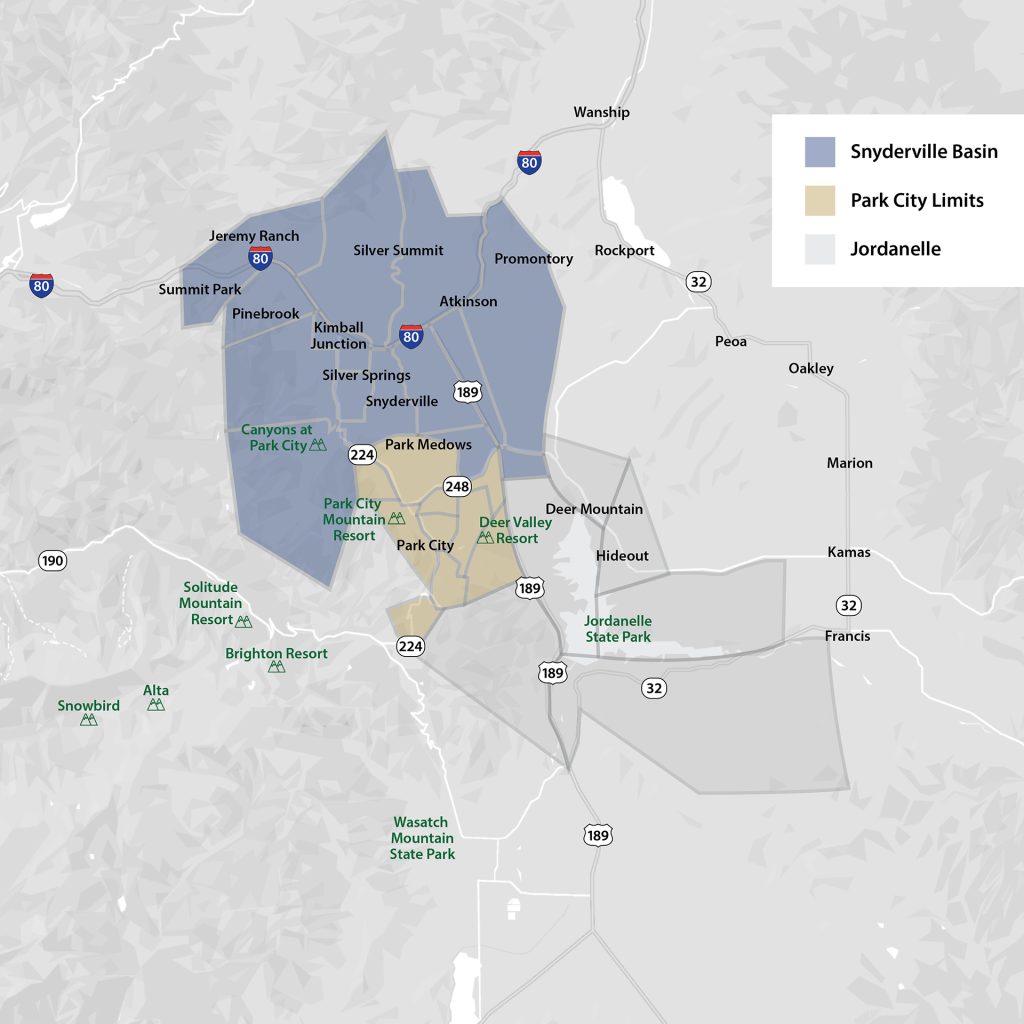

Park City Limits had 31 single-family homes sold, which is a 55% drop compared to the same quarter in 2021, yet when compared to Q1 from 2020 and prior years, we can see that this number falls within the expected sales average. To illustrate just how far pricing has come, the total sales volume for those 31 units was $153,600,500 barring 2020-2021. The next closest quarter by sales volume was Q3 of 2019, which had 53 units sold for $133,938,415.

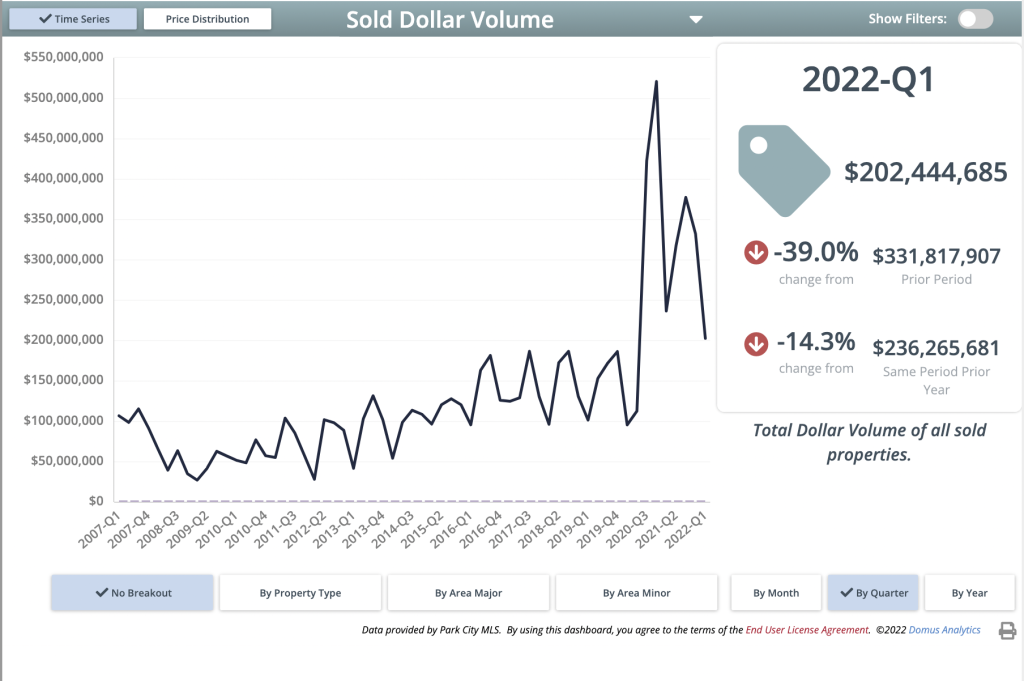

While transactional volume may be returning to equilibrium, we can see that prices are holding firm. Snyderville Basin produced 65 single-family home sales in Q1 for $202,444,685 in volume. To approach even close to that volume, we have to travel back to Q3 of 2017, where the $186,551,617 was supported by 133 homes sold. In an encouraging sign to buyers, a reduction in purchases will aid in the replenishment of inventory, helping to return to a more balanced market.

There was a portion of the market where sales activity was not dropping – the condo/townhome segment. As prices continued their upward trajectory, condos and townhomes began to fill the price gap; with greater supply and lower pricing, many folks opted to look instead toward those products. In the Snyderville Basin, 199 units were sold in Q1 2022, and only Q4 of 2020 was higher. However, the median price of a unit sold increased to its highest level at $1,250,000.

When comparing the median price of a single-family home to that of a condo/townhome, the price disparity becomes apparent: $1.25m vs. $2.7m for the median properties. On the other hand, Park City Limits had increases over the last two years in sold units in the condo/townhome category but not to the level of both Snyderville Basin and Jordanelle, which I would attribute to lower overall inventory and higher price points. There is more available space outside of Park City to build at lower price points.

Update as of Mid Q2, 2022

Beginning in April, 2022, there was a sense that the market was starting to shift. Six weeks later, we know there was undoubtedly a shift – towards a more balanced market, with higher days on the market and buyer resistance to outrageous list prices.

I would like to point out that there is a lot of noise in the media about the housing market. I have seen articles released within minutes of each other lamenting the impending crash that is about to occur, flanked by the opposite praising the robust market and its ability to maintain its course. Remember, no one can predict the future. However, there are several facts we can examine to gain insight.

Inflation is now at a 40-year high. Inflation can be highly disruptive to many industries and can cause friction. The primary tool to battle inflation is increasing the Federal Funds interest rates by the Federal Reserve Bank. The Federal Reserve’s recent rate increases fueled a nearly 2 point increase in the conventional 30-year mortgage rates over the past 2 months, going from 3.75% to 5.75%.

Higher mortgage rates result in higher monthly mortgage payments and decreased affordability for buyers requiring financing. In the Park City market, close to 56% of the transactions were cash, so the impact could be less significant than in a major metropolitan area. However, higher interest rates will undoubtedly sideline some buyers and require others to reassess their budgets.

Higher interest rates may also impact inventory by dampening new construction. When it becomes more expensive to borrow, new construction becomes more expensive, which doesn’t incentivize builders to start moving dirt. Given the extreme deficit of new homes and the backlog of demand needed, a potential slowdown in new construction could hinder inventory replenishment.

The second way rates may impact the market is the “locked-in effect.” Over the last year and a half, owners have had the opportunity to purchase or refinance homes at under a 3% interest rate. These potential sellers won’t be able to afford a new home at both a higher price and higher rate, while others won’t want to give up their record low rate. Buyers that paid for their purchases in cash also had an opportunity to do a cash-out refinance, so just because a property sold as a cash deal does not mean that it remained that way. The “locked-in effect” could contribute to a decrease in inventory.

A rule of thumb is that a 1% increase in interest rates is equal to a 10% increase in purchase price. Buyers who are “sitting on the fence” or “waiting out the market” may want to make a move before further projected rate hikes. On the positive side, a more balanced market will have the benefit to buyers of more choices and less aggressive negotiating than over the past 2 years.

Sellers must adjust their expectations. The “frenzy” of the past 7 quarters is over. Days on market and inventory are increasing, requiring a more nuanced approach to pricing, with prices aligning closer to the previously closed comparable sold properties.

Real estate is the best hedge against inflation and the Park City market is likely to remain strong. Higher interest rates could continue constrained inventory, nevertheless, our statistics show that inventory is indeed rising. We are transitioning to a more “normal” market, which is going to be better for the community in the long run as double-digit price increases are unsustainable.