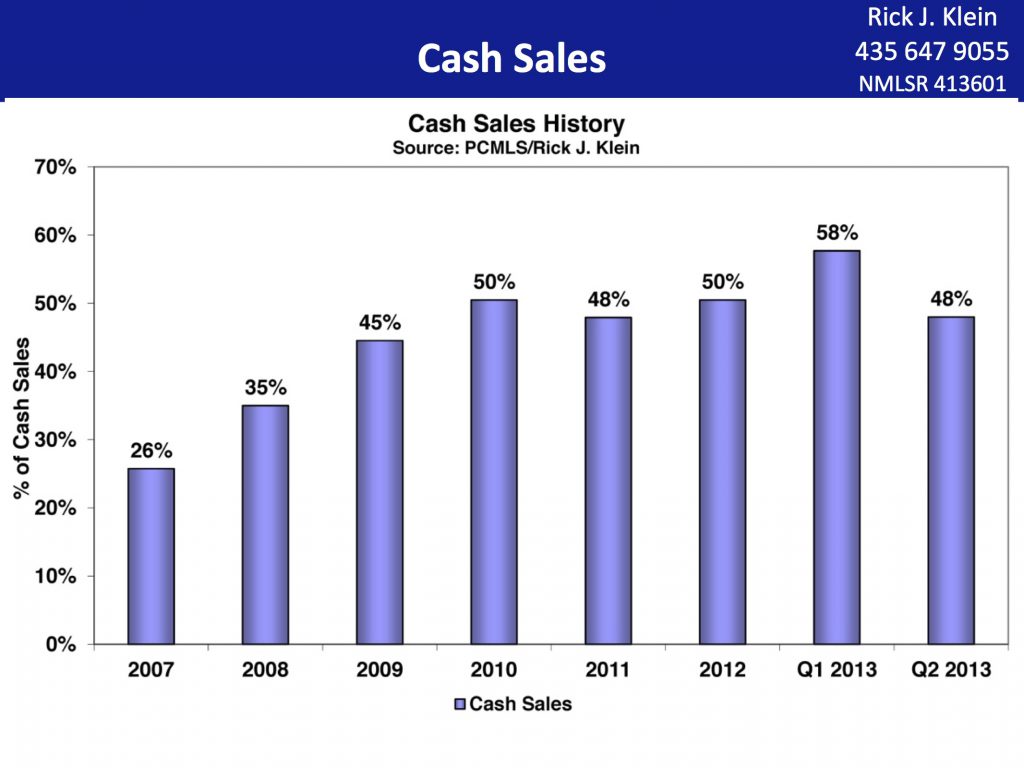

In Park City, cash sales accounted for approximately 50% of all sales in the past 3 years. This is more than twice the rate of all-cash purchases before the housing crash, as seen by the graph posted above.

This dramatic change means there is a good chance you will be competing with a cash buyer when purchasing a home. How do you compete?

You need to get with a reliable, Park City lender and get pre-approved for financing. Pre-approved means you have submitted all required documentation to the lender and you have been approved for financing by their underwriting department.

Most sellers understand that bank cash is as good as a wire transfer from a cash buyer. Cash is cash. Sellers do, however, want to minimize the risk that the contract will fail due to appraisal or lending issues. Pre-approval by a local lender* will instill confidence in the seller that your cash is just as good as the cash buyer’s. The good news is that appraisals have been strong in Park City this year and are not as risky as in past years.

Writing a strong offer, with reasonable deadlines for due diligence, financing & appraisal, and closing, will allow you to effectively compete with a cash buyer.

*We always recommend that our clients work with local lenders. Why? Park City is a small community. Our local Park City lenders understand that if they do not perform, they will not get referrals from local real estate agents. They are highly motivated to be truthful with pre-approvals and rate quotes and to close transactions on time.