As we reach the halfway mark of 2023, it becomes evident that making bold predictions about the Park City market is an exercise in futility. The real estate landscape in this area has ventured into uncharted territory, devoid of any historical precedent that can offer guidance for the remainder of the year. However, it is worth examining some noteworthy statistics from the year’s first half that will help us paint a clearer picture.

Three significant data points define the Park City market:

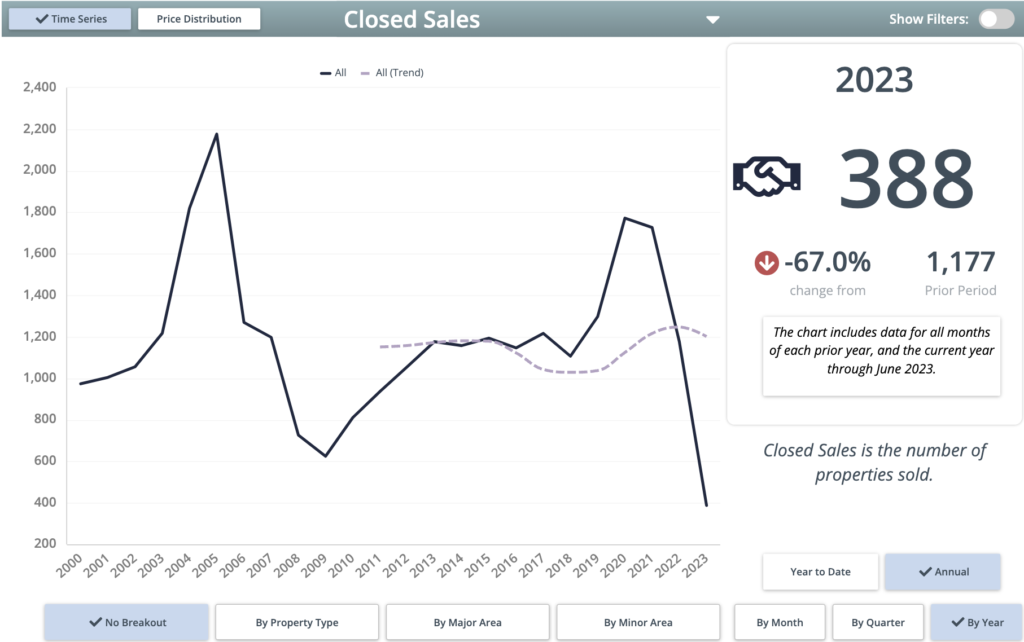

1. We are currently on track to record the third-lowest number of closed properties in a year. With 388 closed properties, we are projected to reach 774 by year-end. The lowest recorded figure was in 2009, with 625 closed properties, followed by 2008, with 727, and 2010 with 811. No, our market is far from crashing. We delve into the reasons for the low number of sales below.

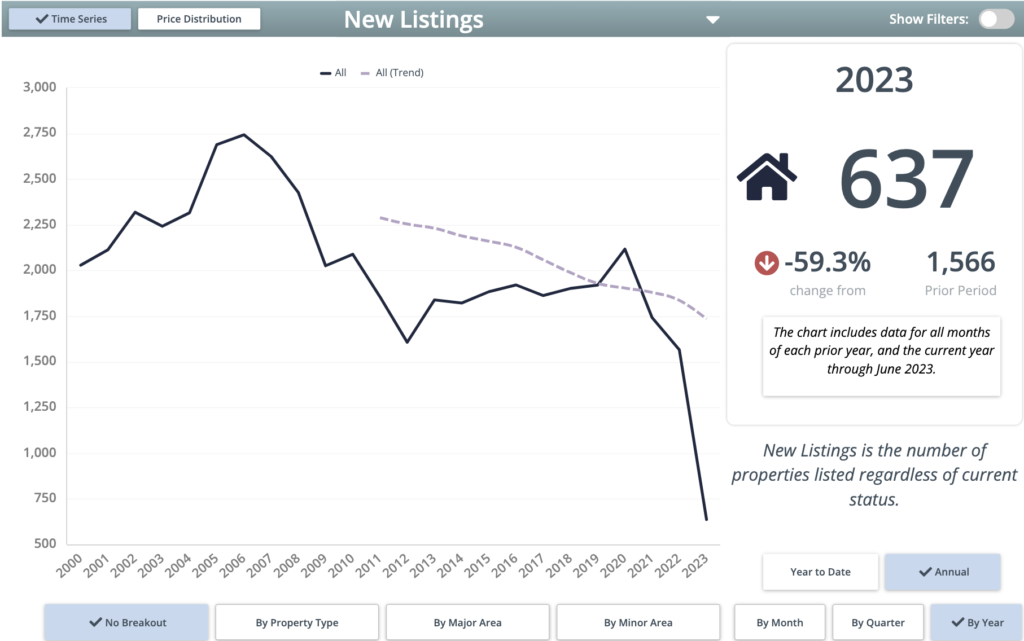

2. The number of newly listed properties is also expected to hit an all-time low. 637 properties entered the market, putting us on pace for a scant 1,274 by year-end. To provide some perspective, 2022 holds the record for the least number of new listings at 1,566. This stark contrast highlights the scarcity of new properties entering the market. Spoiler alert—it’s no surprise that the lower number of listings is directly correlated to interest rates.

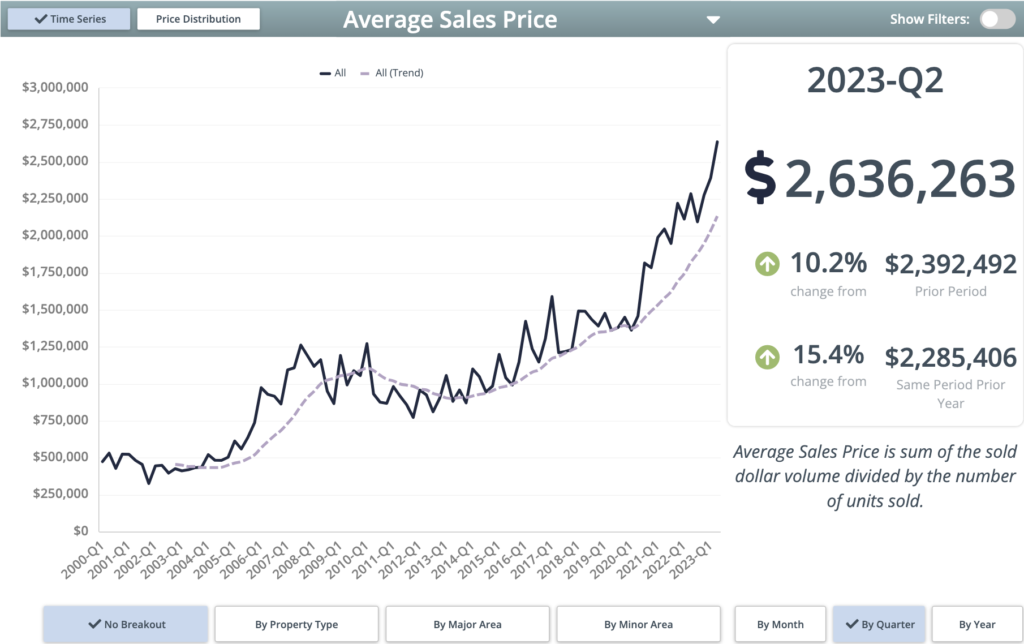

3. The average and median sales prices are projected to reach new record highs in 2023. Each quarter thus far has established new benchmarks for sales prices in these categories, with the Q2 figures beating the record-setting Q1 figures. However, as explained below, this rise in prices is highly segmented and does not impact every neighborhood.

Let’s delve deeper into these data points.

Regarding item #1, it is essential to note that the abysmally low sales figures in 2008-2010 were primarily a consequence of the global financial crisis. Additionally, it is crucial to consider the record-breaking inventory available in that time frame, which amounted to nearly 3,500 available properties in Park City in 2009.

In stark contrast, as of 2023, we have only 817 properties on the market. Therefore, it is vital to establish the proper frame of reference for analyzing total sales. These two markets exhibit completely different velocities; with the current market having such little inventory, downward pricing pressure has been tempered.

Moving on to the second data point I extensively covered in my Q1 analysis, it is evident that property owners are predominantly holding onto their properties, contributing to the lack of inventory. This behavior can largely be attributed to the increase in interest rates. Many individuals are unwilling to relinquish their low-rate mortgages or cannot afford a lateral move due to higher monthly payments. Others are fueled by optimism (“hopium”) and believe next year may present more favorable conditions for buying or selling.

Interest rates have the most significant impact on the entry-level segment of our market. In Park City, properties priced at $3 million and above accounted for 31% of sales in Q2, while those priced at $1 million and below constituted only 26% of sales. Delving further into the inventory that changed hands, we find that only 24% of properties sold in Q2 would be classified as “Primary Residence” based on their general location. Consequently, the primary driving force behind Q2’s market activity was high-end resort properties catering to second-home buyers who could disregard interest rates and remain active.

The third data point is the relentless upward trajectory of the Park City market’s average and median sales prices. However, it is crucial to recognize that these figures may be skewed due to the significant activity in the market’s top tier relative to the entry-level segment. Every market is segmented and nuanced, which requires specific analysis. For example, in 2023, the median price for Jeremy Ranch experienced a decline of 21.4%, while Silver Springs saw an 8.3% decrease. Conversely, Empire Pass, an area in Deer Valley, has witnessed a substantial 35.3% increase, and Promontory has enjoyed a growth of 22.6%.

These divergent trends indicate that areas where people primarily reside are depreciating, while luxury communities that predominantly serve as second homes are experiencing appreciation. Though as mentioned above, nuance is everything and looking through the inventory available and that sold is very important.

The Silver Linings for Buyers and Sellers

Property owners in Park City, that have owned for as little as two years have a tremendous amount of equity. With low inventory, there is less competition, making it an ideal time to sell. However, it’s important to prepare your property for the market and price it correctly.

Acting instead of reacting is crucial to ensure you sell quickly and for the highest price. Buyers have more options to choose from and more time to make decisions, so it’s important to make your property stand out with competitive pricing. Currently, we are in a traditional buyers’ market, but as interest rates come down, demand is expected to rise. There are silver linings for both buyers and sellers.

The Park City market in 2023 presents a unique set of circumstances. With record-low numbers of closed properties and new listings, alongside unprecedented average and median sales prices, it is clear that this year will be marked by transactional scarcity.

While interest rate increases have influenced buyer behavior, it is crucial to recognize the segmented nature of the market, with different areas experiencing varied price dynamics. As we move forward into the year’s second half, it will be fascinating to observe how these trends continue to unfold in this uncharted territory.

It is important to remember that timing the market is not possible and that for any of your real estate needs, your timing is the only timing that matters. That is why I sold my house in the dead of winter and bought one closer to where our life is in Park City. I didn’t particularly want to give up my interest rate. Still, I knew that making this move at this time was right for my family, and I recognized that even though I could’ve sold for a more significant amount last year, I also would have paid more for the home we purchased.

We do not know if the FED will continue to increase interest rates or how long they will stay high. We also do not know what property values will do in the future, and it is a futile exercise in trying to make the stars align.

I will leave you with this quote from Warren Buffet:

I don’t think we’ve ever made a decision where either one of us (referring to Charlie Munger) has either said or been thinking: ‘We should buy or sell based on what the market is going to do.’

Warren Buffet

This article was written by my partner Justin Altman. He can be reached at 435-640-8681 or justin.altman@sothebysrealty.com.