My husband retired at the end of last year and has the time to look at our stock portfolio every day. For people like us who have worked for every dollar in their savings, the recent market corrections and fluctuations can be disconcerting.

According to experts, although the economic data suggests U.S. and global growth to accelerate in 2018, markets are expected to remain volatile for the short-term as central banks raise their interest rates and inflation becomes more of a possibility. Indeed, mortgage rates are starting to rise and are predicted to increase to 5% for a 30-year conventional loan by the end of 2018.

Diversifying Your Portfolio in a Volatile Market

I suggested to my husband that maybe it was time for us to diversify our investment portfolio by purchasing another rental property. I told him that I found a condo that would provide a fixed 5.0% return on our cash investment after paying someone else to manage it. Buying real estate is a hedge against inflation, as inflation will cause rents to rise and property prices to increase.

So, we did it and we close this week. I chose a long-term rental property in Park City’s 84098 where there are more full-time residents than tourists. I like the monthly cash flow and I like someone else managing my rental properties. I have clients who have been equally successful buying resort properties and managing vacation rentals through Airbnb or VRBO.

Current Condo Inventory and Prices in PC

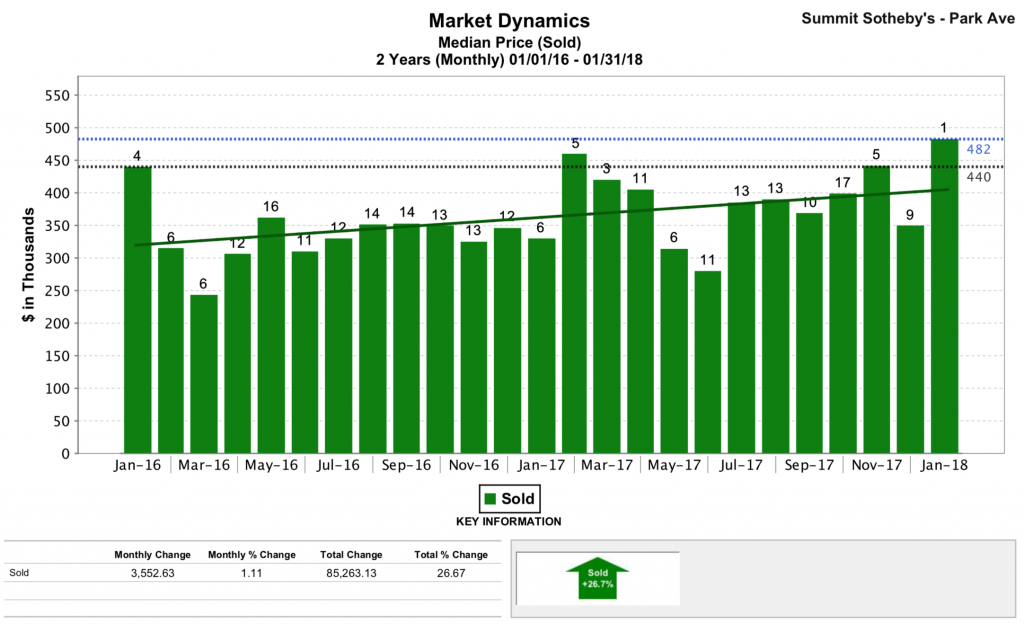

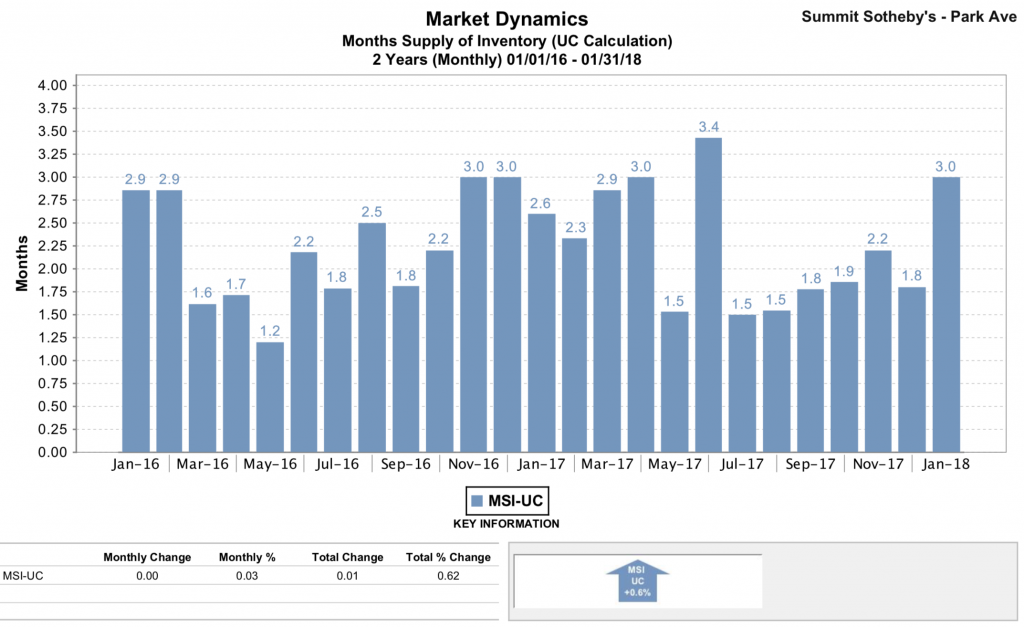

The charts below show condominiums (excluding the Canyons area) priced under $500,000 in 84098. You can see that inventory is always tight in this category and prices have been rising a healthy 5 percent per year over the past 2 years.

If diversifying your portfolio with real estate is an attractive option for you, let’s discuss. I can suggest the best properties with well-managed HOAs and reasonable HOA dues. I can also suggest property management companies if that is something of interest to you.

5 Comments

Thank you for your blog post.Really thank you! Awesome.

Very timely thoughts my friend! Excellent!

Nancy Tallman, thanks! And thanks for sharing your great posts every week!

Nancy Tallman,thank you for this post. Its very inspiring.

Thanks for expressing your ideas on this blog. In addition, a misconception regarding the finance institutions intentions any time talking about foreclosed is that the financial institution will not take my repayments. There is a degree of time in which the bank is going to take payments every now and then. If you are way too deep within the hole, they should commonly call that you pay the payment 100 . However, that doesn’t mean that they will not take any sort of repayments at all. When you and the lender can seem to work a little something out, a foreclosure course of action may cease. However, if you ever continue to miss out on payments underneath the new approach, the foreclosed process can pick up from where it left off.