About a year and a half ago, I wrote a post title “Bye, Bye Foreclosures”

About a year and a half ago, I wrote a post title “Bye, Bye Foreclosures”

What is the picture like today?

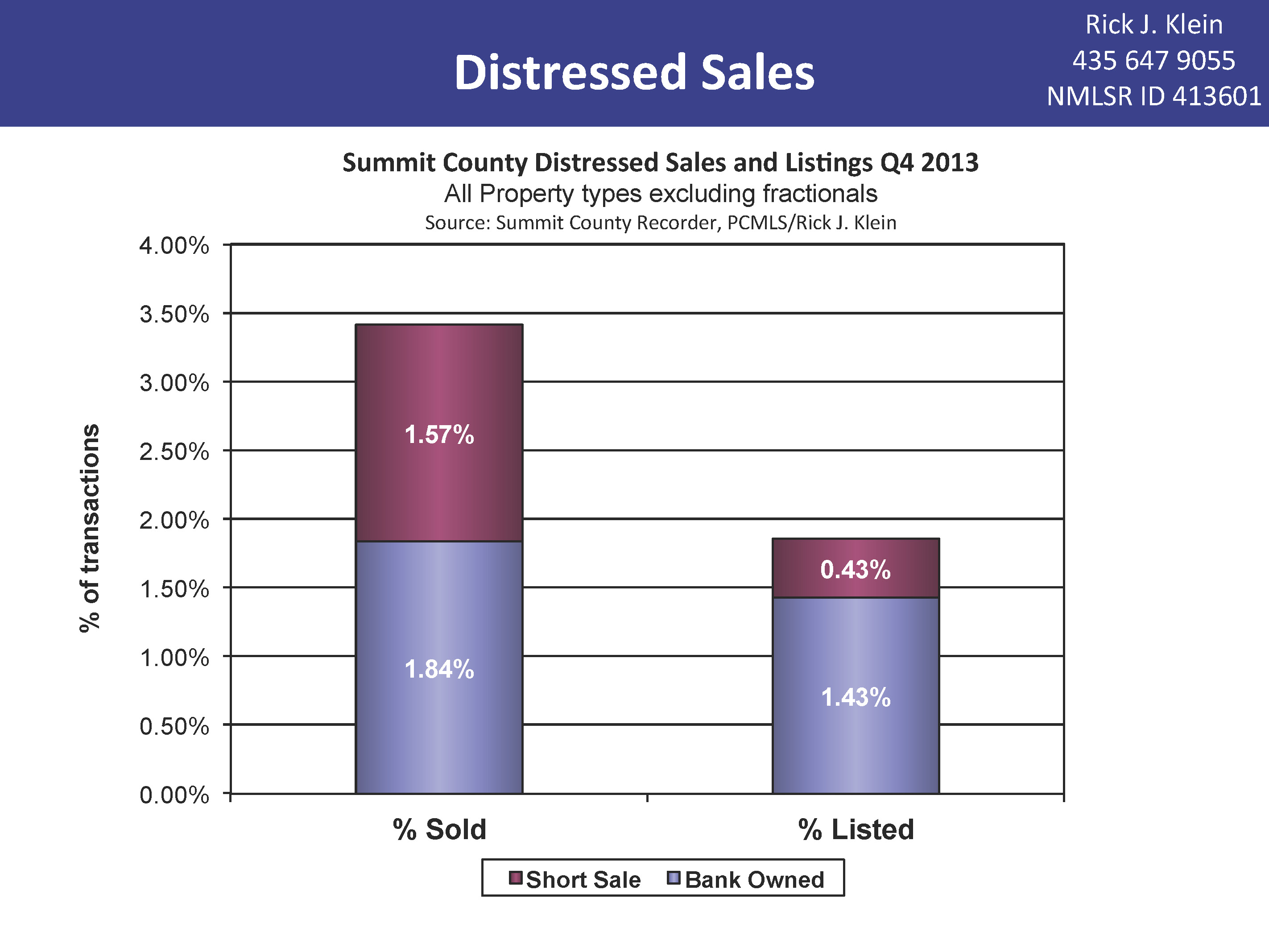

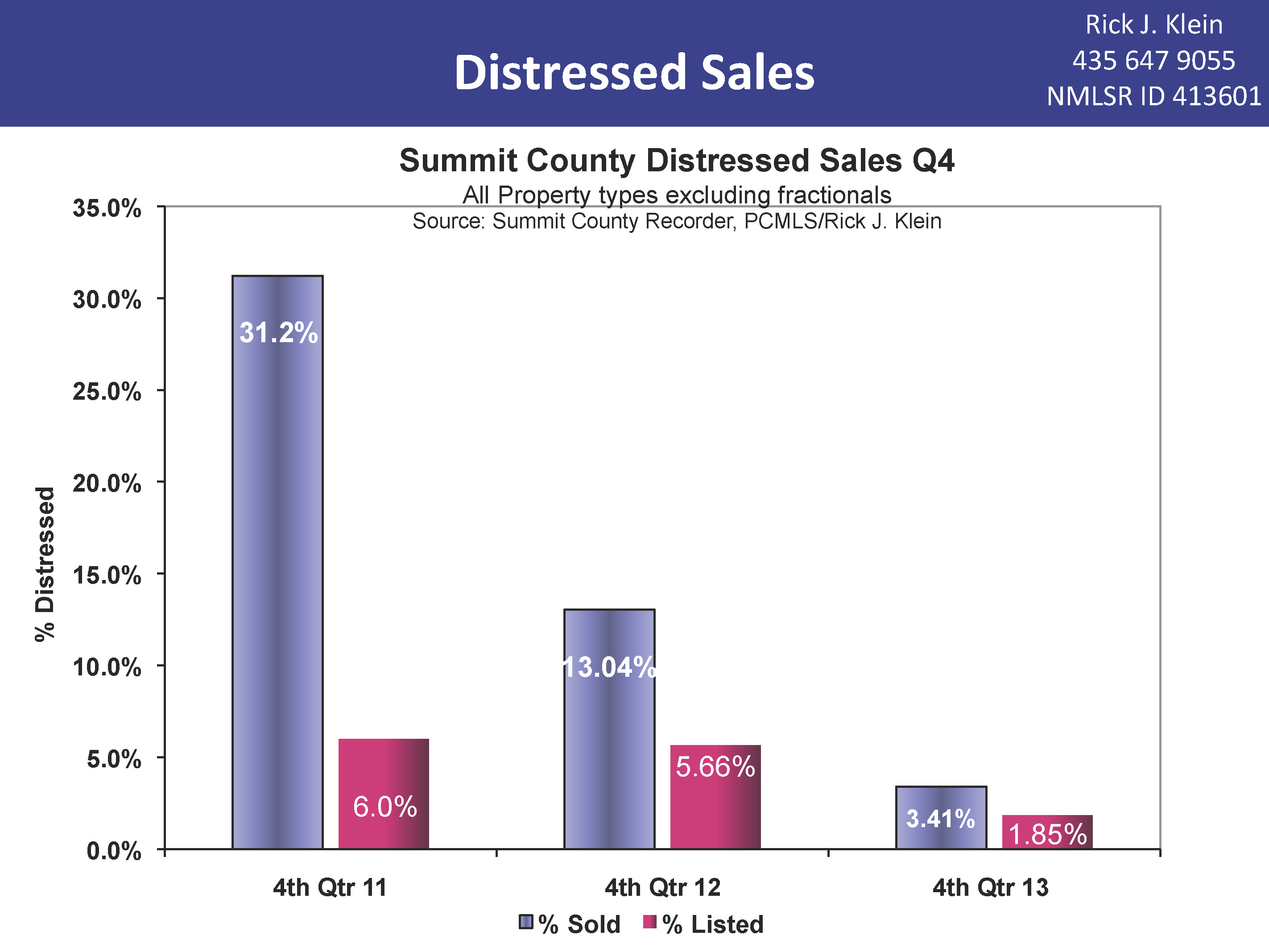

The opportunity to buy short sales and foreclosures continues to decline. Distressed properties accounted for less than 2% of all listings and less than 3.5% of sales in the Greater Park City area during the last quarter of 2013. The average discounted price was only 2% off retail.

Nationally, distressed sales accounted for 25% of all sales last December, with an average discount price of 18% off retail.

This is great news for the Park City real estate market. Buyers should feel confident that although they missed the bottom of the market, the absence of distressed property means our market has recovered. It’s good news for sellers, too. They no longer have to price against distressed properties or worry about bank owned sales that will skew appraised values.