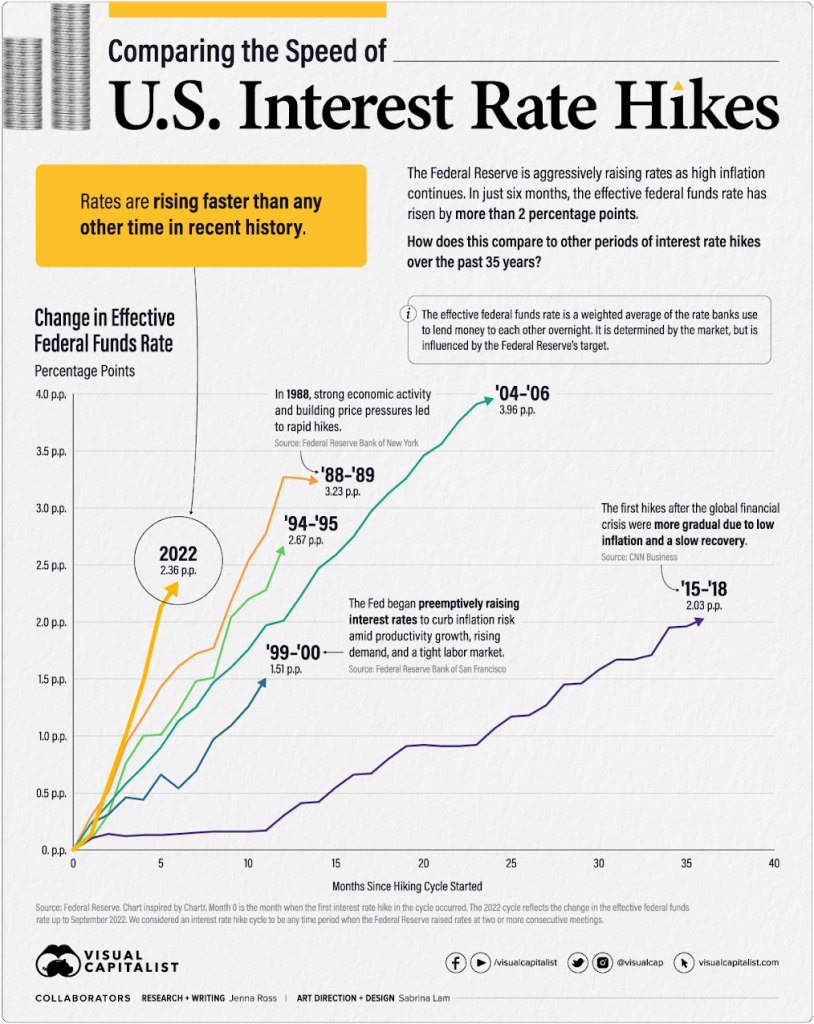

I cannot overstate the impact of the Federal Reserve and Jerome Powell on the housing market at large throughout 2022. I believe Q4 is a perfect illustration of an artificially restricted market. Historically, there has never been such a rapid rise in interest rates in such a short window. Rates have been higher, and they have had a more significant nexus but have never shot up so quickly. Lightning-fast interest rate increases significantly reduce purchasing power and put considerable pressure on buyer demand, slowing the market.

Keep this data point in mind as we parse the data from Q4, primarily because our drop in demand was associated with a decline in supply.

Here is a quick reminder from Econ 101: When supply increases, prices drop until we have an equilibrium with demand leveling off prices. Conversely, when supply decreases, prices increase until we have a balance by reducing demand and growing inventory. What happened in Q4 was neither of these; supply and demand decreased simultaneously, with the market experiencing more of a pause than a correction. As such, pricing didn’t experience much movement!

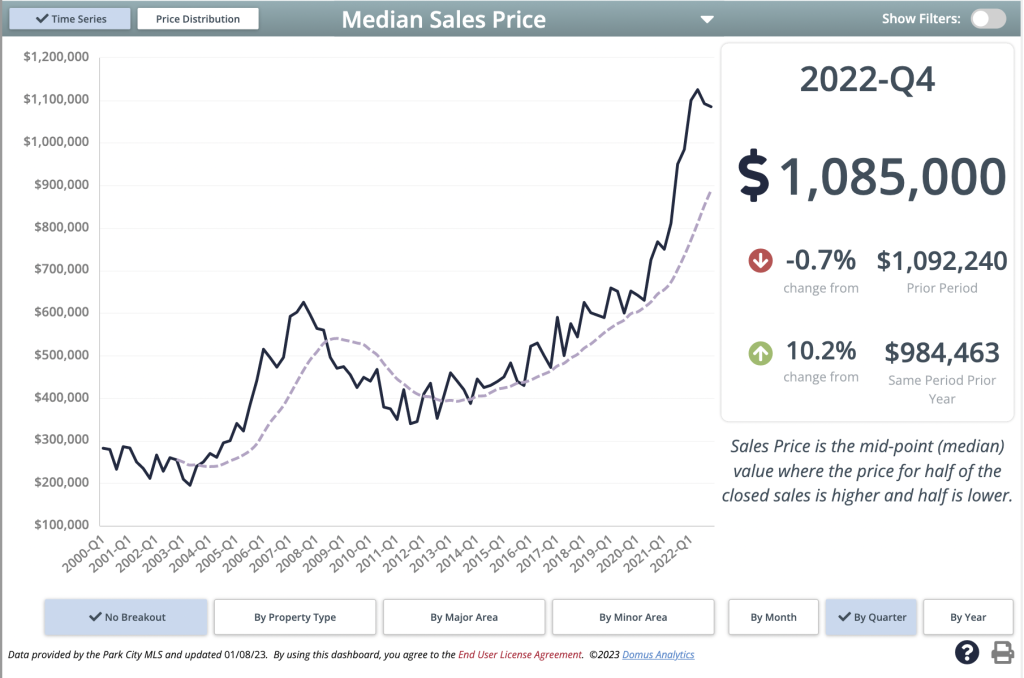

Let’s break it down and examine what the median price did in Q4.

Across our entire marketplace, the needle hardly moved, with a slight reduction of 0.7% from Q3, which was the peak!

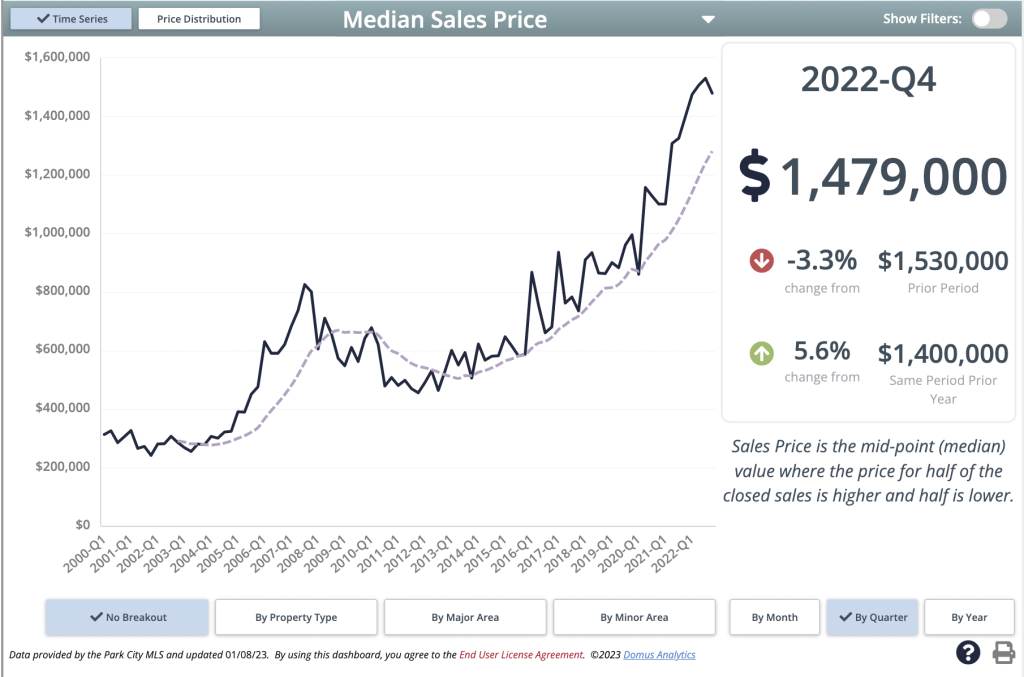

Within the Greater Park City area, there was a bit more room on pricing as the median came down 3.3%, which, as you can see from the graph, is well within norms over a year.

The real estate market in Park City has shown remarkable resiliency, particularly while many markets across the county have had boomerang reactions in pricing and large influxes of inventory. Decreasing inventory is one of the most significant factors that keep our pricing level steady. Let’s go ahead and take a look at our inventory levels.

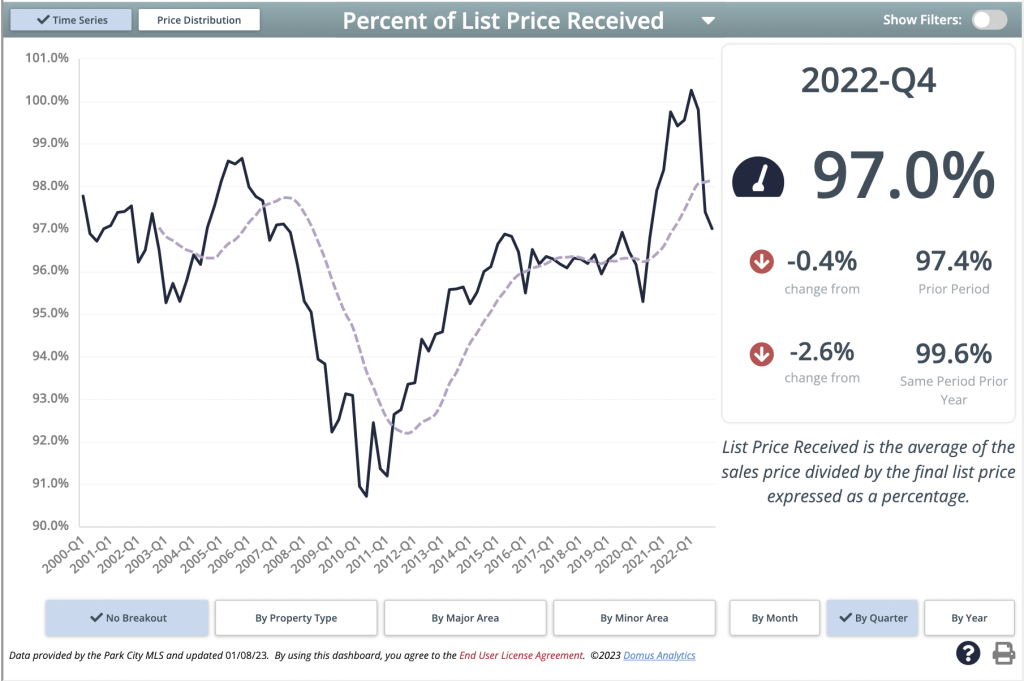

A 10% drop in inventory is not peculiar on its own, especially in the context of Q3 to Q4, but low inventory coupled with low buyer demand is unusual. Especially when we already have historically low levels of inventory. However, even with the reduced buyer pools, highly desirable properties were still seeing multiple offers.

The same story unfolds in the Greater Park City area, with a 10% drop in inventory, keeping us around a 50% inventory deficit from the pre-Covid period. As long as inventory is a challenge, it will keep pressure on pricing – even with a decreased buyer pool.

I have covered this previously, but it is imperative now with some ridiculous headlines being floated out there. Year-over-Year comparisons, especially 2021 vs. 2022, are not fair because both years are statistical outliers. We will likely never see another market as we saw in 2021, and any comparison against it will look incredibly bleak. It makes more sense to look for comparisons over pre-Covid years and try to glean insight. Comparing a more normalized market to the greatest real estate market in history makes for great headlines, but doesn’t provide any insights.

While historical data cannot be used to predict the future, it gives us some insight into what we may see. However, unpredictable externalities hold a massive influence over marketplaces. With that in mind, what does our current market mean for buyers and sellers?

Buyers are in a good position right now with many sellers willing to negotiate price and terms, allowing plenty of time for due diligence and loans. Inventory is tricky; even though buyers have less competition, there are fewer properties to select. That is why some properties are still moving very quickly at 100% of list price. Buyers must be aggressive if they find the perfect property. It may be perfect for several other buyers, as well.

Sellers are also in a unique position due to the low levels of competition, which may stay low throughout 2023. Interest rates have some homeowners “locked in,” which will sideline some sellers, allowing those trading up or down to have less competition. That said, preparing a home for the market is vital, not just in price but also in presentation. It may require work, but it is a beauty contest that sellers want to win.

When I look at Q4, it seems more and more like people just hit the pause button – this makes sense. Interest rates and inflation were rapidly increasing while inventory was decreasing. The holidays and international travel pulled people out of the market, and we had an incredibly quiet quarter transactional.

However, as we begin the new year, lenders are signaling mortgage rates will be more stable and could start to move down. Showings and showing requests have increased, and it feels as though there is a renewed energy around the market after the last few months of softening. Real estate as an investment has a long-term horizon and is one of the few asset classes that you can functionally use.

Blue Chip stocks sure look good in a stock portfolio but being able to ski out of your investment looks a bit better, in my opinion. Thank you for reading; if there are any areas or neighborhoods you want a deep dive into or want to discuss the market in greater detail, reach out!

This article was written by my partner Justin Altman. He can be reached at 435.640.8681 or justin.altman@sothebysrealty.com.