Summertime in Park City is magical. People will often visit in the winter for the excellent snow and skiing available, then come back in the summer and fall in love with our little town. It is also the busiest time of year for local real estate for a few reasons.

First and foremost, the school calendar tends to dictate the available windows for families to move. Regarding ski properties, summer provides a break from rentals with availability to market and tour. We also have many part-time owners from warm states such as Texas, Arizona, Nevada, and Florida who avoid the hot summers by escaping to the mountains.

It stands to reason that Q3 should have been a strong quarter from a numbers perspective — and it undoubtedly was, relative to Q2. However, broadening the scope, I would say Q3 was underwhelming. There are a couple of specific numbers that tell the tale; let’s dig into them.

Greater Park City Area (84098 and 84060) Data Breakdown

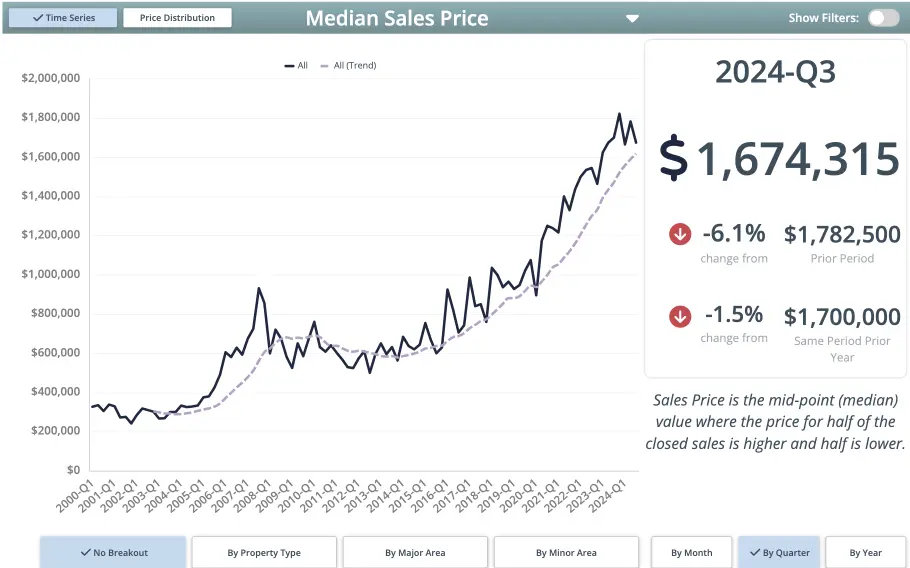

Median Sales Price: $1.674 M, down 6.1% from Q2

Average Sales Price: $2.358 M, down 7.6% from Q2

Closed Sales: 258, up 11.2% from Q2

Sold Price/Sq Ft: $749, down 10.3% from Q2

Pended Properties: 295, up 31.7% from Q2

Properties Listed this Quarter: 379, down 11.9% from Q2

Active Inventory: 716, up 7.5% from Q2

Key Takeaways from the Data

Inventory is still a driving force in the marketplace.

Although active inventory increased in Q3 and has been steadily climbing this year, the Park City area remains about 30% below the standing inventory available before Covid. On the one hand, it is a massive contributing factor to pricing staying relatively stable over the last two years; on the other hand, it is leading us towards another year with low sales volume.

Median and average sales prices have slipped relative to the previous quarter but remain near all-time highs.

Many factors can influence these numbers, and since we operate in a market with a smaller sample set, they can get skewed. I found that in Q3, the median original list price for all properties was $1.85M, a 10% drop from Q2. While several factors influence pricing, if the properties listed during this quarter started with a lower list price, it doesn’t necessarily mean that prices have depreciated; it could indicate that a higher proportion of properties listed and sold were just a lower price relative to the previous quarter. This is why it is essential to take stock of your neighborhood and look at recent comparable sold properties to determine valuation. One part of the market could be up or down and may not indicate other parts of the market are doing the same.

The average % of the list price received is 96.1%, which is the marker that tells you how close to the list price the property sold at.

If a property was listed for $1M, the average closed price would be $961,000 (96.1% of the list price). This number has been steadily skewing down, not at a particularly quick rate, but it indicates to me that buyers right now are having more success than they have had in recent times negotiating with sellers. This is why my advice to buyers right now is if you find a property that checks the boxes and the timing works for you, try and make the purchase now instead of waiting. There is a good opportunity to negotiate more off the purchase price now versus spring, when there is usually more competition from other buyers.

Even in a market where over half the sales are cash, interest rates still rule the day.

Parsing through the Q3 data, what I discovered is that September had the highest number of properties that went under contract by about 10%. This is a surprise because it is inverted from what we typically see. July and August tend to do the bulk of the work for Q3 and September is where it tapers off – largely due to school starting and summer ending. However, I anticipate that the FED rate cuts provided a spark to the market and people who were previously waiting on the sidelines decided to get into the game.

Market Outlook Going Forward

Given that September was stronger than usual (courtesy of the 50-basis point interest rate cut from the FED), we may have a few weeks of stronger than usual activity in Q4 before tapering off as we head into shoulder season. Overall, the market appears to be in a stable place, and although we may end the year with low sales volume like 2023, it appears the light at the end of the tunnel is getting brighter.

If selling is on your mind, now is the time to begin strategizing for the spring market. We can provide our recommendations to prepare your home for the market and you will have plenty of time to get ready. If you are a buyer, fall is a great time to explore Park City and its neighborhoods. The town is not crowded with visitors and lodging rates are low. We can help narrow your search, ensuring that when the right property pops up, you are ready to jump on the opportunity.