The double digit market appreciation we have been experiencing in Park City the past few years is finally starting to show signs of leveling off. This is evidenced by fewer sales combined with rising inventories in all sectors of the market.

The double digit market appreciation we have been experiencing in Park City the past few years is finally starting to show signs of leveling off. This is evidenced by fewer sales combined with rising inventories in all sectors of the market.

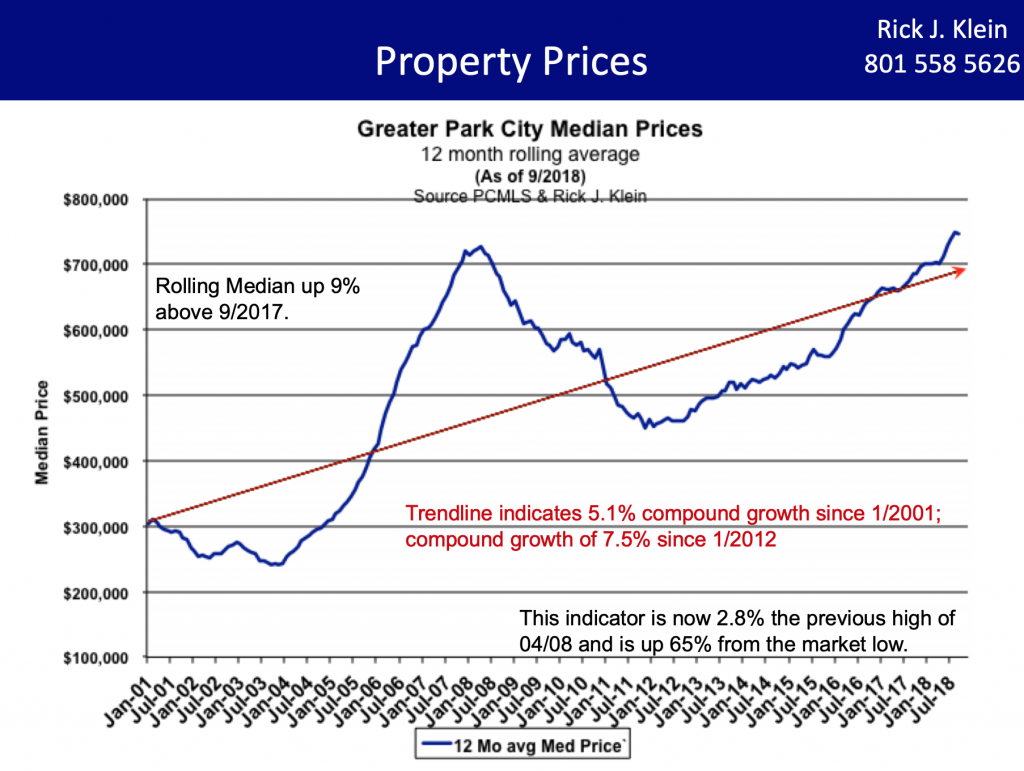

Total dollar sales, median and average sale price continue to climb and are at record highs, well past the records set at the peak of our market in 2007. Median sale price is up 65% from the previous market low and 2.8% above the previous market high.

It is interesting to note the difference in demand for properties priced below the median price point in each area:

Park City 84060

(City Limits)

The average days on market for single family homes priced below $1,950,000 was 5.7 months, while homes priced over $1,950,000 were on the market for 19.5 months.

Park City 84098

(The Snyderville Basin including Silver Springs, Trailside, Promontory, Pinebrook, and Jeremy Ranch)

The average days on market for single family homes priced below $1,200,000 was 2.8 months, while homes priced over $1,200,000 were on the market for 11.7 months.

I believe this leveling off is healthy for our market. We can not continue to have double digit price appreciation indefinitely.

Please let me know if you have specific questions about your neighborhood. I’ll be glad to forward the data.

Many thanks to Rick Klein, Wells Fargo Private Banking, for his analysis of the Wasatch Back MLS Statistics and slides.