It’s always a treat when Lawrence Yun, Ph.D., Chief Economist for the National Association of Realtors (NAR) visits Park City. We prepared some highlights of his presentation to share with everyone.

Are We in a Recession?

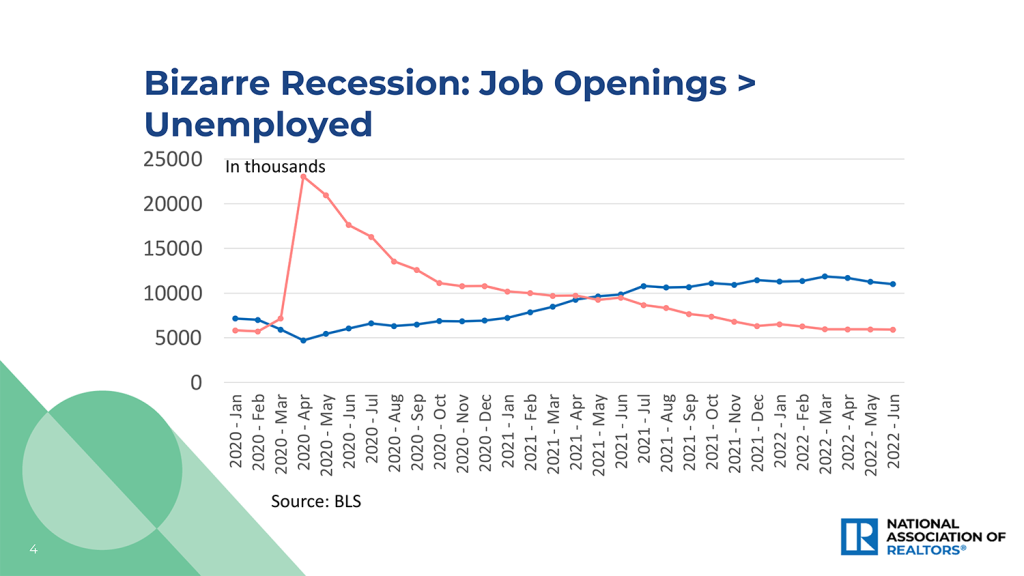

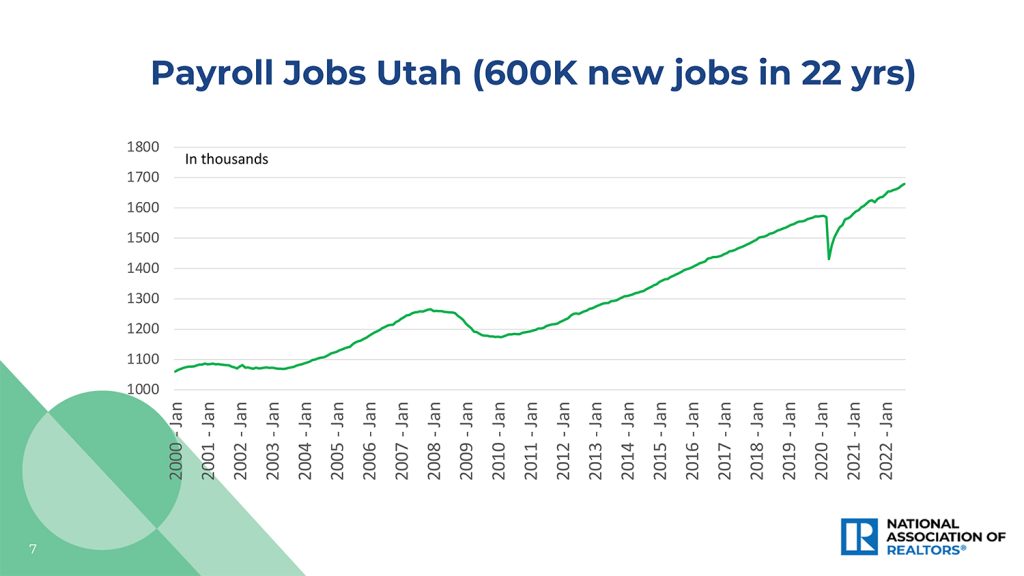

Lawrence spoke about how we likely won’t know we’re in a recession until economists meet a year from now and decide we were in a recession. By then, it could be over! However, if we are in a “recession,” it is rather atypical because the number of job openings and unemployment is inverted. Utah’s powerful economy has added 600,000 jobs in the past 22 years. Since 2020, Utah has been second only to Idaho in job growth and payroll growth.

The Problem with Mortgage Rates

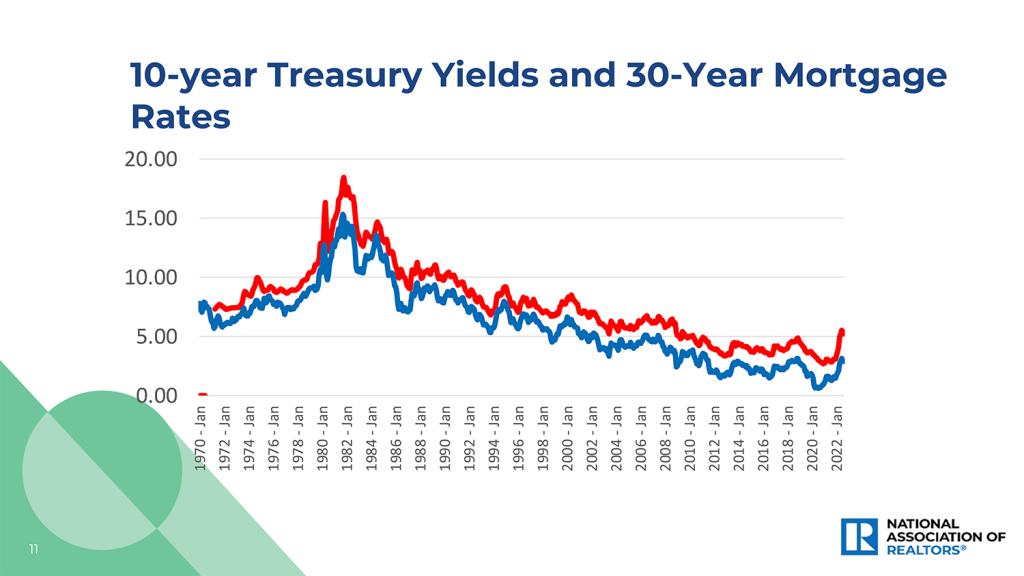

This slide is a good reminder that home mortgage rates do not follow the interest rates from the Federal Reserve, which are the interest rates charged to banks, not consumers. Mortgage rates have a strong correlation to the 10-year Treasury Bill.

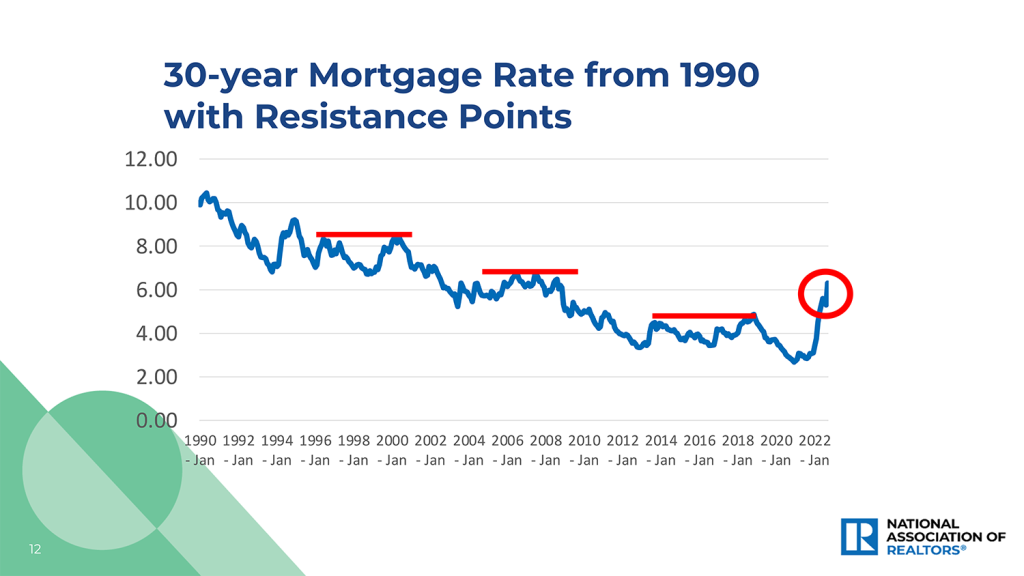

Lawrence noted three different resistance points or glass ceilings for mortgage interest rates. The question a few months ago was whether or not we would be going above the most recent resistance point of the low 5’s, which we absolutely shot through.

The next point to watch is right around 6.35%. This is where interest rates are today. Since the Federal Reserve has announced they will be raising rates again in November and into 2023, there is some hope banks will continue to offer loans to borrowers at about 6.35%. However, if we pass through 6.35%, the next likely spot to settle would be around 8.2%, which Lawrence noted will not be good for the real estate market.

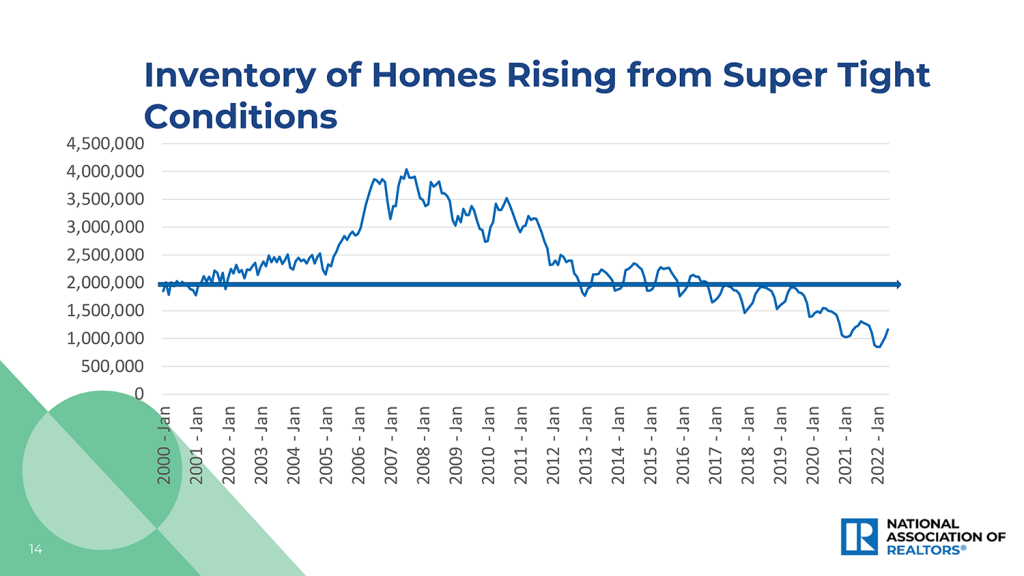

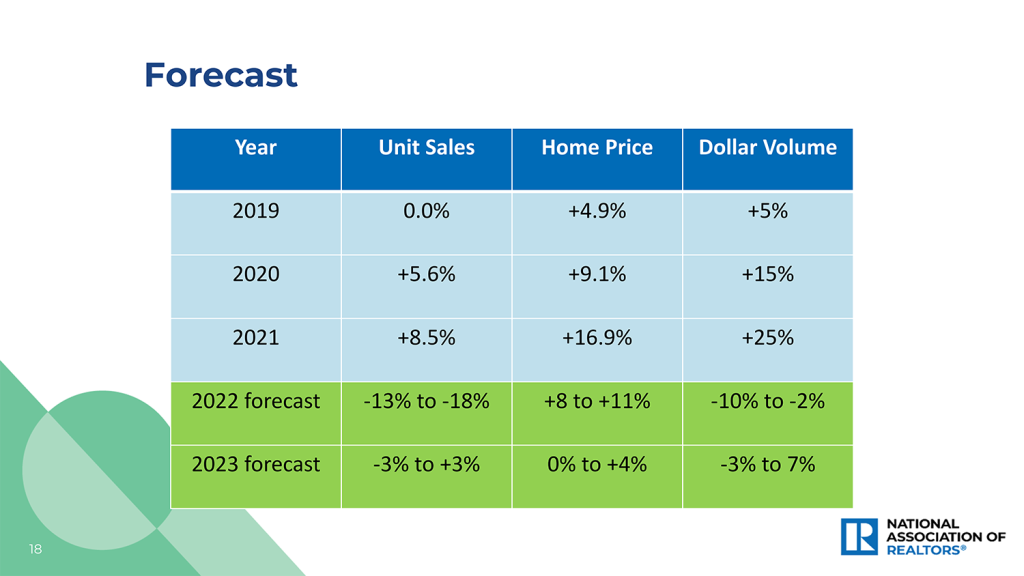

The slowing of the housing market is directly linked to mortgage rates, so it is unlikely that we will see any market stability until there is stability in interest rates. However, we are buffeted by low local and nationwide inventory, which will keep prices steady. The “locked-in” effect will contribute to a lack of inventory. (This refers to people who bought or refinanced when rates were low and who are unlikely to move, especially laterally, with an interest rate that will raise their mortgage payment by 50%.) It is a double-edged sword, which will contribute to price stability at the expense of total sales and inventory.

Lawrence predicts 2023 is shaping up to be a year with minimal movement in pricing and a lower total amount of sales.

The takeaway here? Inflation will make cash worth less tomorrow than today. If you are waiting for prices to drop before you buy, and you need to obtain financing, your payments may be exactly the same due to rising interest rates. If you are planning to sell, rising interest rates will mean your property is affordable to a fewer number of buyers.

Make sure you are taking advice from experienced, real estate experts instead of real estate writers or anchors interested in sexy headlines and clickbait. If you have any questions we’re always here for you.