The first quarter has come and gone, and with it, we find that Park City has firmly planted its flag as one of the hottest luxury real estate markets in the country. There is certainly a benefit to Deer Valley more than doubling in size and bringing along billions in new real estate development with it. The communities and brands associated with the Deer Valley expansion (Four Seasons, Grand Hyatt) are new names in the Park City market and bring with them a level of luxury that was previously unseen.

Combine this with the incredible access of Salt Lake City International Airport and the private Heber Valley Airport, the accessibility to a major metropolitan center, and relative affordability compared to other luxury ski resort markets, and you have the perfect conditions for our marketplace to erupt.

Park City Real Estate 2025 Q1 Stats

The numbers behind this quarter are very strong and suggest that a significant amount of wealth is pouring into Park City. While the quarter ended with some level of uncertainty due to tariffs and volatile equities markets, we are still seeing strong demand within the real estate sphere, particularly at the top end. Historically speaking, real estate has been a solid hedge against inflation. A lesson some investors learned during the Covid years was that when the economy lacks stability, a tangible asset that you can use and build memories with is a great place to park money. Let’s get into the details.

2025 Q1 Key Sales Metrics

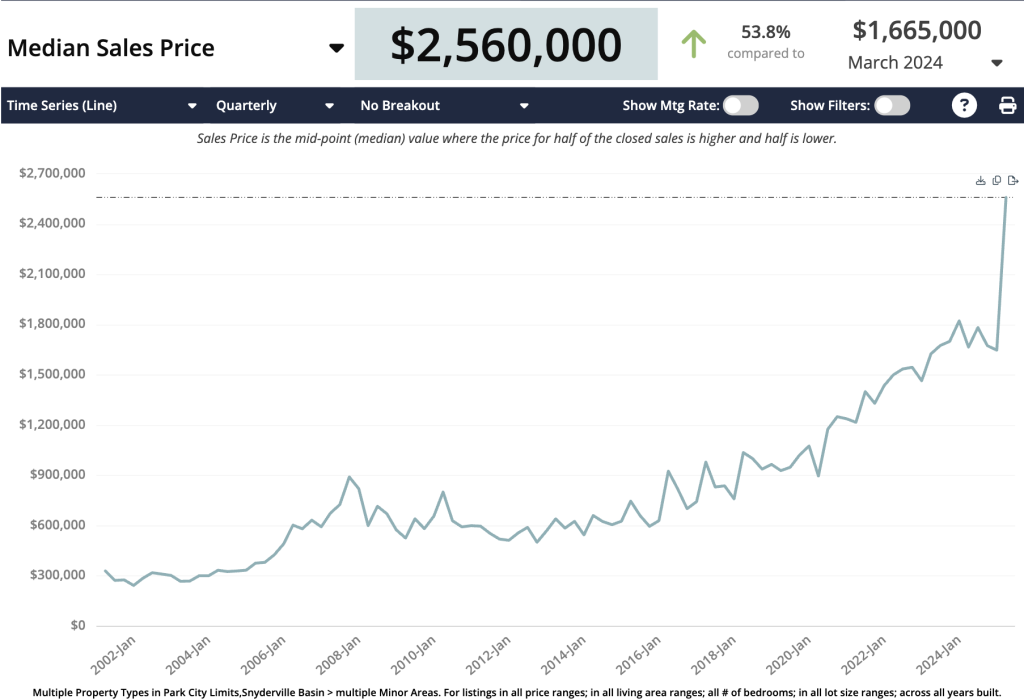

Median Sales Price

- $2.546m, the same quarter last year $1.665m, up 52.9%

Average Sales Price

- $3.668m, the same quarter last year $2.703m, up 35.7%

Closed Sales

- 229, the same quarter last year 176, up 25.6%

New Properties Listed

- 384, the same quarter last year 356, up 7.9%

Let’s talk about the obvious: the median and average sales prices for condos and single-family homes in the Greater Park City areas (Snyderville Basin, Park City, and Hideout) skyrocketed. Look at the historical charts below.

It is very easy to look at data and assume the Park City market is experiencing great appreciation and everything is just flying off the market. This is true only for a specific segment of the market. The more interesting analysis around these numbers comes when we look at the price distribution of the closed sales this quarter. When you look at that, it begins to make more sense.

Clearly, the sales are weighted heavily towards the top end of the market. When you have more properties sold in the $5m to 9.99m range than you do in the $1m to 1.49m range, that says a lot about which buyers are active in the market, and 12 sales over $10m would have been unheard of just a few years ago.

As the price point moves up, the ratio of financed vs cash purchases begins to skew as well. Given that mortgage rates have stayed higher for longer than many “experts” predicted and show no signs of slipping, it is no surprise that the top end of the market, which is not as sensitive to mortgage rates, is more active while the lower end stays quiet. This quarter, 56.1% of all sales were “cash” purchases; however, as we move up in pricing, that ratio increases as well.

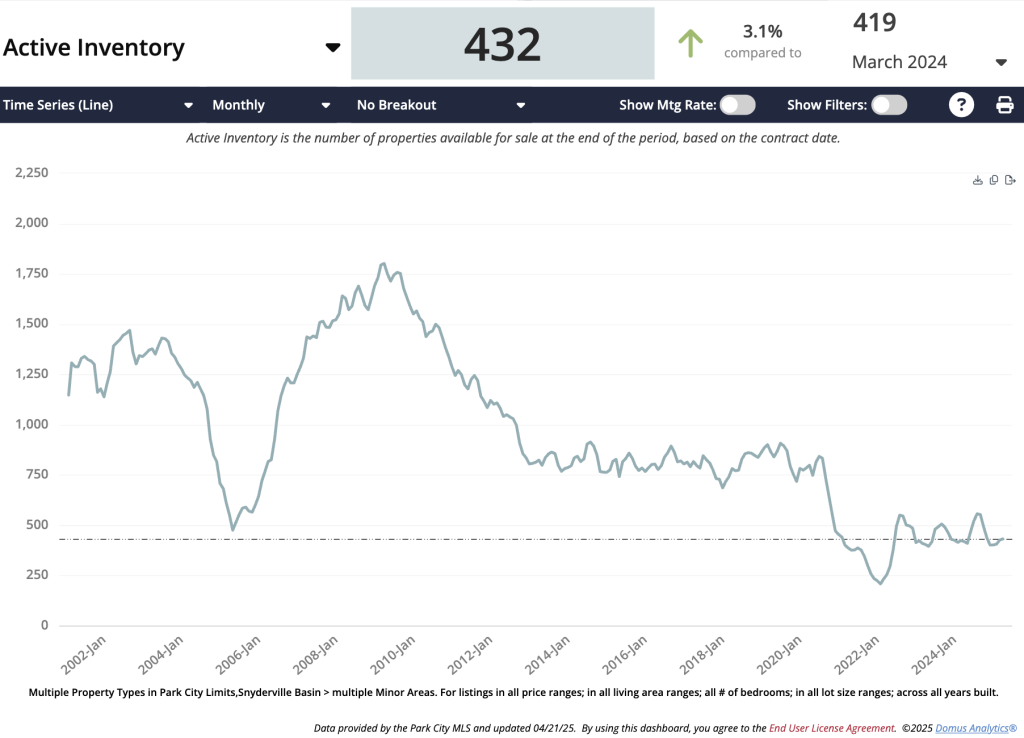

2025 Q1 Park City Area Inventory

Inventory continues to be a driving force behind pricing as well, and while new inventory increased in Q1 relative to Q1 last year, the constraints still mean that demand is not met. I have been writing about low inventory for years. I am including this chart because I think we are close to entering a “new normal” when it comes to inventory, as it does not appear to be returning to pre-Covid levels.

Since the start of 2022, there have been small ebbs and flows in our inventory, but it has remained stable. Pricing is a direct result of demand, and until there is enough inventory to satiate demand, we will continue to see pricing stay level or move up – this is a trend where Park City breaks with the rest of the country.

As we enter the second quarter, don’t be surprised to see a lull in activity. It is typical as ski season ends and we enter “mud season” that activity drops for a handful of weeks and begins to build as we approach Memorial Day and see visitors return. Here are the key things to keep in mind.

- Sellers need to have a strong understanding of their position in the marketplace and have an honest look at their property through the buyers’ eyes. For a large portion of the landscape, this is not the market for aspirational pricing.

- Buyers need to have an understanding of what they are looking for ahead of time and know which portion of the market they are entering. The level of competition for certain properties is fierce. Incredibly, we have even seen competition for properties that have been on the market for an extended period. Being prepared and building a strong offer will get you the result you want.

The Park City market is highly segmented. If there is any specific area or neighborhood you would like to know more about, or if you want to get into the nitty gritty statistics, please reach out! It is more important than ever to work with a skilled and experienced real estate advisor who can help you navigate this complex market.