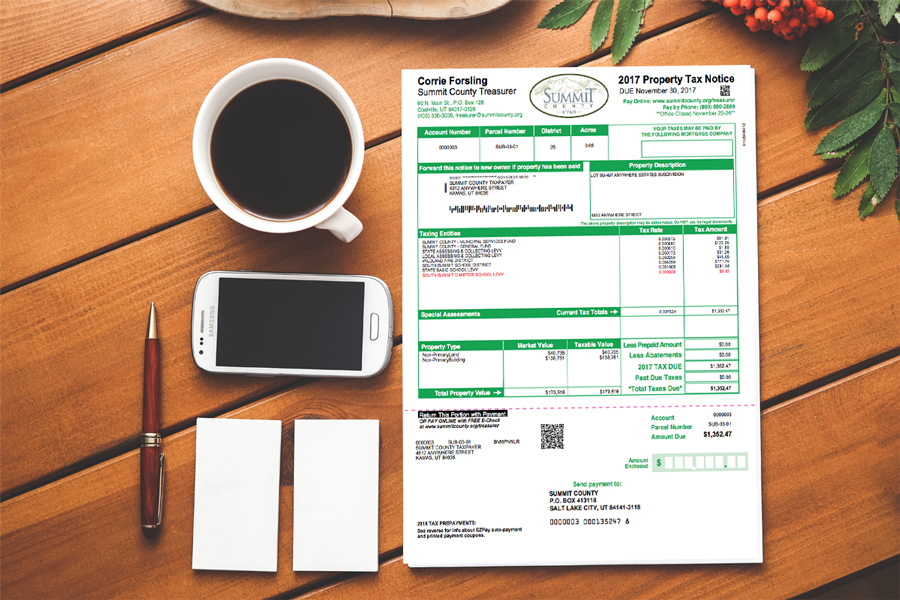

Did you just receive your 2017 County Property Tax Notice? Have you had your coffee yet? It’s time for a run down of something every real estate owner has to deal with. Like it or not, it’s time to pay property taxes.

Did you just receive your 2017 County Property Tax Notice? Have you had your coffee yet? It’s time for a run down of something every real estate owner has to deal with. Like it or not, it’s time to pay property taxes.

Below you’ll find the when, what, where, why and how for Wasatch and Summit County property taxes in Utah. I’d like to thank Summit County Treasurer Corrie Forsling for reviewing this blog for accuracy.

Why do we have a property tax?

Properties are taxed to pay for schools, fire and police protection, and other public benefits in proportion to the value of each home or vacant lot. Property taxes are a more stable source of public revenue than sales and income taxes because they do not fluctuate when communities have recessions.

When are property taxes billed?

Property taxes are billed in November for the calendar year and are due by November 30th. If you buy or sell a home during the year, the taxes will be prorated based on the closing date.

How are properties assessed?

Each August, the county Assessor will send a notice to the owner of the assessed value of the property and the taxes. If you are a primary resident or you rent your property to a primary resident, your property will be taxed at 55% of the assessed value of your home. If you own vacant land or an investment or second home, your property will be taxed at 100% of the assessed value.

The assessed value does not change upon the sale of your property because Utah is a non-disclosure state and sales are not reported to the county Assessor. However, the Assessor will reassess properties statistically every year, and is required to visit the property every five years.

What if you disagree with the assessed value of your property?

If your opinion of the value of your property differs from the Assessor’s, you can submit an appeal. The deadline for appeals is September 15th, and the Assessor will only change the value of your home if you submit the appeal on time. On SummityCounty.org, there is a “Request for Appeal of Real Property Market Value” form. Here’s the one for 2017. You can use this form to appeal the market value of your home. If you believe you qualify for the primary home exemption, you’ll need to submit the “Signed Statement of Primary Residence” found at SummitCounty.org/Assessor.

If you are appealing the market value, you will need to submit one of the following along with the form described above:

- Comparable sales supporting the value of your home. (I have helped my clients with this data).

- Documentation that you purchased the property in the same year for less than the Assessor’s market value.

- A property appraisal completed within one year of January 1st of the tax year.

- Provide a description and supporting evidence if the Assessor made a factual error (square footage, number of bathrooms, etc)

For more information, visit: http://summitcounty.org/Faq.aspx?QID=61

Want to chat about Park City Real Estate? Let’s have coffee sometime.