Four Things That Surprised Me About the Q3 FHFA Housing Data

When you buy a property through me, you receive an annual real estate review on your purchase anniversary that includes federal housing data from the Federal Housing Finance Agency (FHFA.) I always look forward to reviewing the numbers, even though they have been pretty predictable. Quarter 3 of 2022 surprised me in a couple of ways.

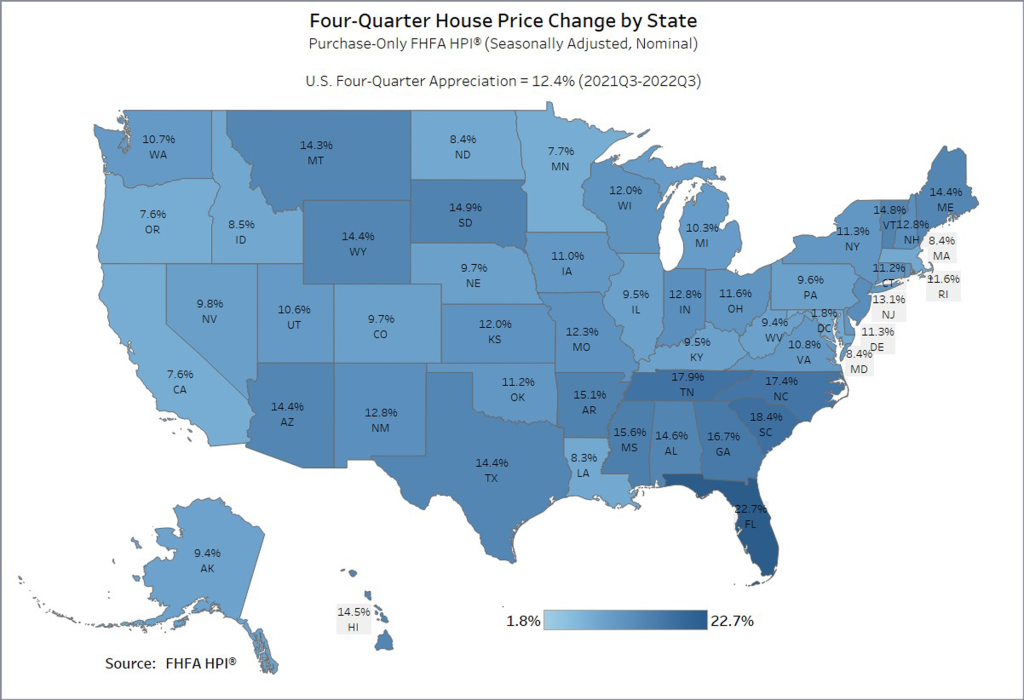

1. Percent Change in Housing Prices by State

For years, Utah was in the top 3 on this list for annual appreciation. In quarter 3 of 2022, Utah dropped to number 33! I look at this as a very good thing. You can’t have double digit appreciation forever.

Utah’s one-year annual appreciation was still a healthy 10.61%, although appreciation dropped in Q3 — to 2.42%. Utah’s 5-year appreciation is nearly 90%.

In case you are curious, the top 5 states for appreciation were Florida, South Carolina, Tennessee, North Carolina and Georgia. The 5-year appreciation for all of these states ranged from 75-90%.

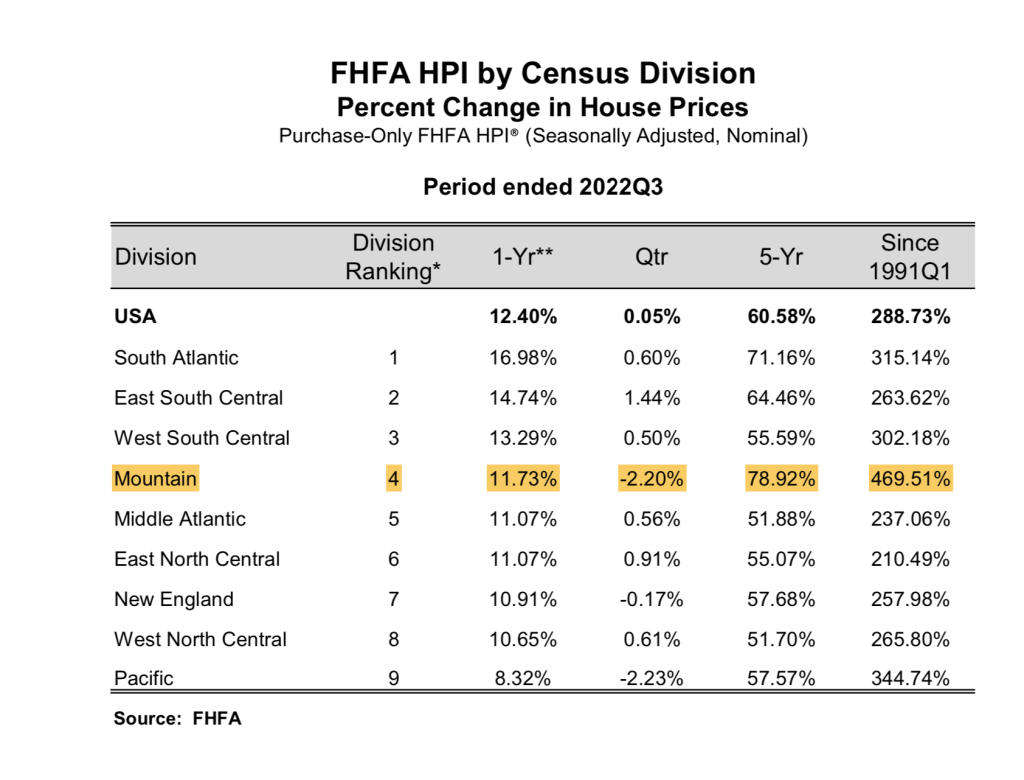

2. Percent Change in Housing Price by Area (Division)

Once again, the Mountain area shows stability with a slight decrease of -2.2% in Q3. The Mountain area had the highest appreciation in the last 5 years.

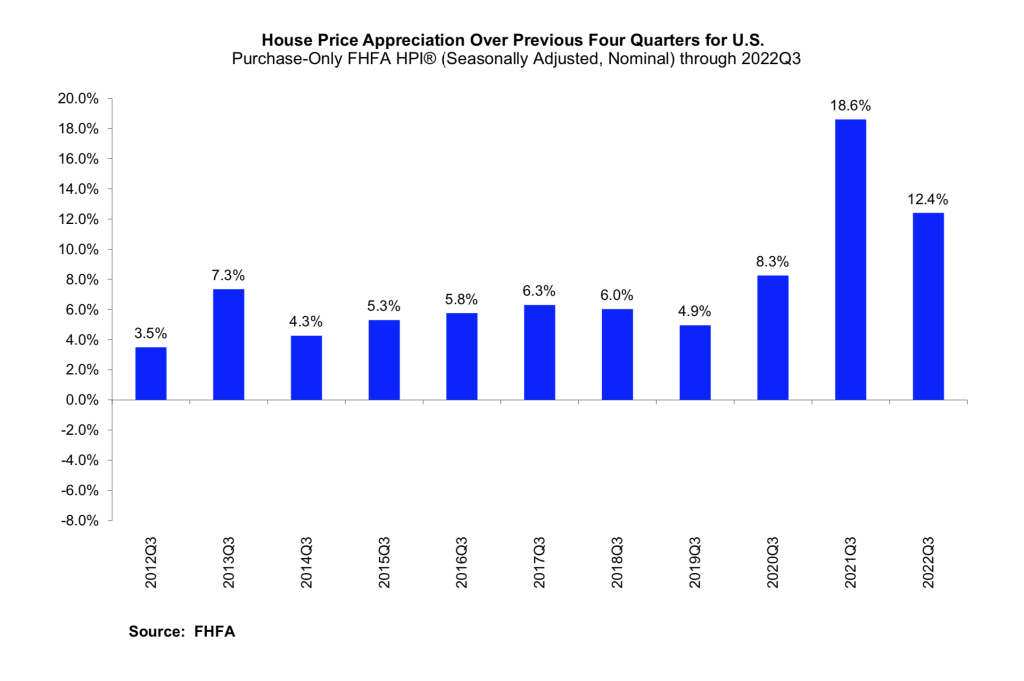

3. Housing Price Appreciation Over Previous Four Quarters for the U.S.

The rate of appreciation is decreasing overall. Generally, the U.S. has averaged about 5% long-term appreciation for single family homes. We are certainly headed back in this direction.

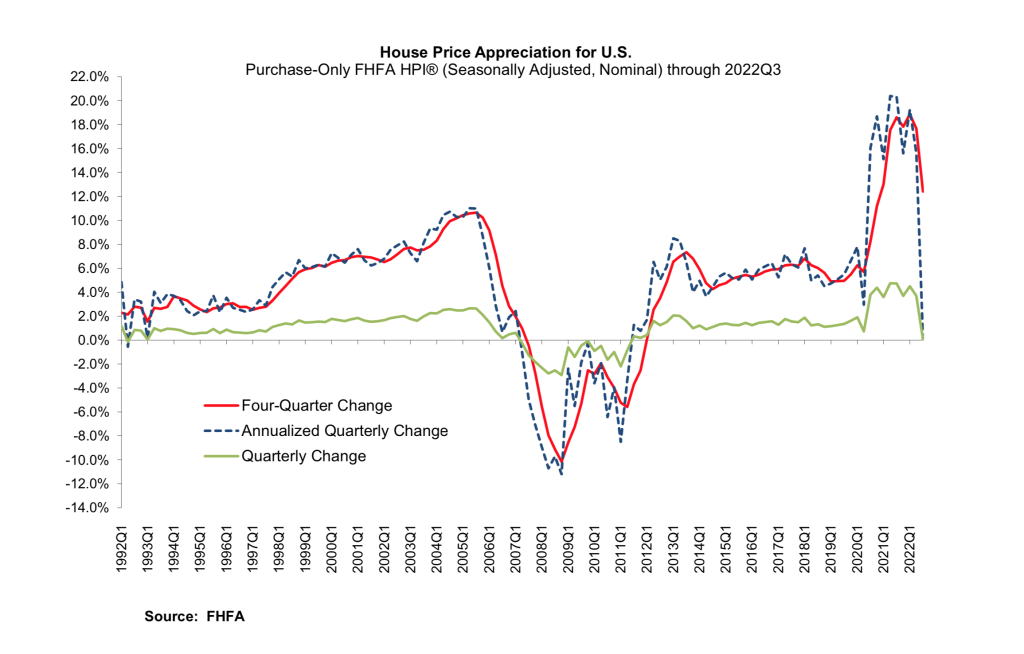

4. Monthly House Price Index for US from January 1991 to Present.

This visual shows how steep price increases were in the past 3 years. But even in the worst housing crisis, prices eventually recovered.

Putting it all together

This is real data by the federal government, not a press release by Zillow or Redfin who are in the real estate business. Real estate has proven to be an excellent long-term investment. It is impossible to time the market and those who have the staying power to “sell high” always win. Of course, I’m biased, but when I read about all the corporate scandals it makes me appreciate real estate as an investment because it’s something I can see and control.

Now is a great time to buy real estate in Utah. Prices are stable for the first time in over 10 years and the selection is wonderful. No matter your budget, you have a great opportunity to find something that you will love.

What about interest rates? Traditionally, 50% of all sales in Park City are paid for in cash. This year, nearly 75% of my transactions have been cash. Those financing purchases are taking advantage of adjustable-rate mortgages knowing they can sell or refinance before the adjustment period. If you are trying to time the market and are “waiting” for a crash, you might miss one of the best opportunities in a long time.