Last week I attended the National Association of REALTORS (NAR) Regional Conference in Park City.

Lawrence Yun, PhD, the NAR’s Chief Economist gave a presentation. I always love hearing his opinion on the real estate market. These slides were taken with my iPhone during his presentation because I wanted to share a few of his key points with my clients and friends.

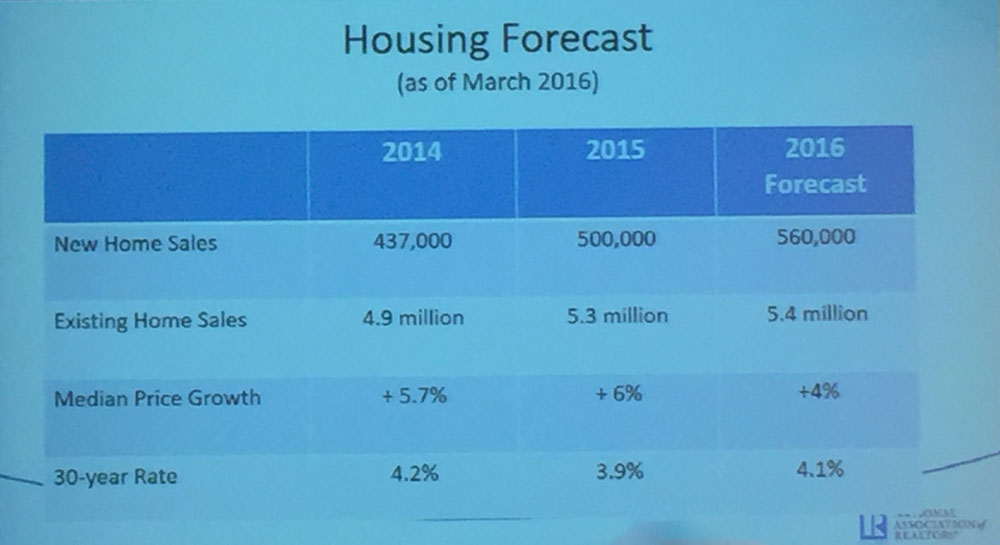

His housing forecast for 2016 is quite interesting. There will be more new homes entering the market, but existing home sales will still rise. Median price growth is expected to slow to 4%, which is still above the traditional average of 3%. Mortgage rates are expected to remain flat during this election year.

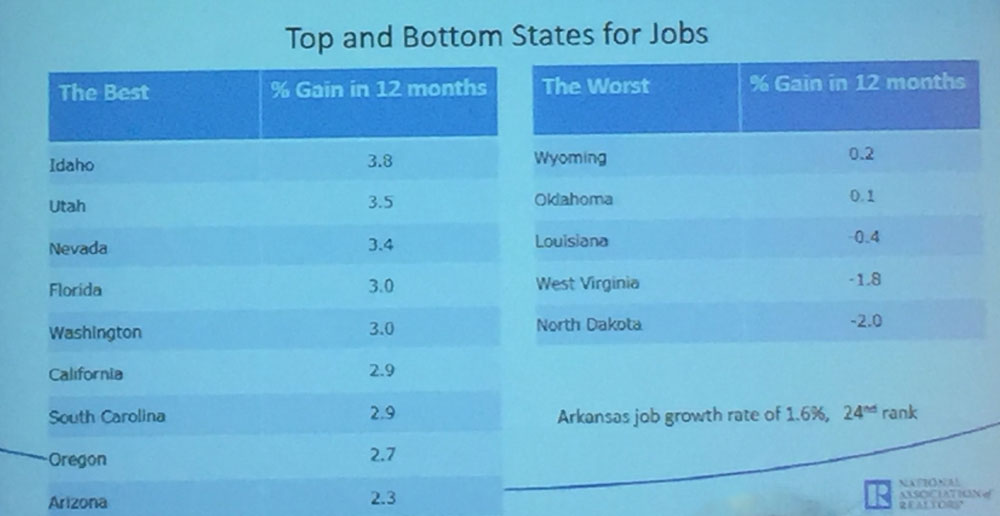

Top and Bottom States for Jobs

As I have written before, Utah has the best economy in the United States. I was surprised to see we have fallen to second in job growth, but the fact of the matter is that Utah is gaining a lot of jobs. And job growth means employees who need to live somewhere. Park City has always been a top choice for executives relocating to Utah with their families. As I have written about previously, even Park City is seeing job growth in the technology sector.

As I have written before, Utah has the best economy in the United States. I was surprised to see we have fallen to second in job growth, but the fact of the matter is that Utah is gaining a lot of jobs. And job growth means employees who need to live somewhere. Park City has always been a top choice for executives relocating to Utah with their families. As I have written about previously, even Park City is seeing job growth in the technology sector.

Would Home Sales Rise?

Dr. Yun touched on the factors that are associated with increased home sales. As you can see on the slide above, “job creation” is “super good” for rising home sales. He associates rising mortgage rates and too fast rising prices as “not good” for home sales. The good news is that he predicts mortgage rates will remain stable through 2016 and the Park City data shows a very stable real estate market. Dr. Yun also predicts that as housing prices come back to where they were before the recession, sellers who had negative equity and could not move are creating pent up demand as the timing is finally right for them to make a change. The “boomerang buyers” in his slide are those who had to wait 7 years after a foreclosure or bankruptcy and are now able to re-enter the market.

It’s always informative to hear national experts discuss real estate. Dr. Yun’s slides and comments further convince me that the Park City real estate market is sound and will remain stable throughout the year.

1 Comment

It is interesting to know that the Chicago Tribune recently had an article that said there was, “An IRS decision this month means unmarried couples with mortgage debt of more than $1.1 million can deduct more mortgage interest than married couples, potentially saving them tens of thousands of dollars a year.” http://www.shilozitting.com