The media has picked up the fact that home ownership rates are low among “Millennials”. What is less apparent is what a boon this is for potential real estate investors. Last month, I attended the National Association of REALTORS® (NAR) Annual Convention. A highlight was listening to NAR”s Chief Economist, Lawrence Yun, Ph.D., share his thoughts and predictions about the real estate market. These slides and this blog are taken from his presentation.

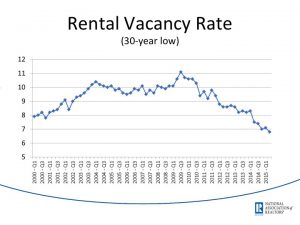

In his presentation, Dr. Yun mentioned that during the recent economic downturn, there was very little new construction. This has resulted in lower inventory and fewer affordable homes available, especially for first time home buyers. First time home buyers also have a hard time qualifying for financing as 41% have student loan debt of $25,000 or more. Finally, competition from vacation buyers and investors paying cash has made it more difficult for first time home buyers to compete when there are multiple offers. For these reasons, there is an historic low home ownership rate of young people under 35 years of age.

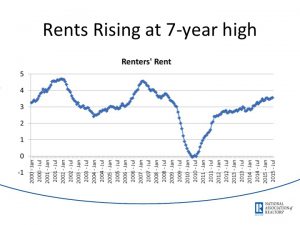

Home ownership rates are falling and predicted to fall even further. This makes buying and holding long term rental property a great investment strategy. The pool of qualified renters has never been better and rental rates are predicted to continue rising. There are some great rental properties available in the Park City area. In addition to solid rental income, Park City properties have seen solid appreciation over the past several years. Contact me at 435.901.0659 to learn how you can leverage this national economic trend to your advantage.