This thorough roundup and analysis of Q2 2022 stats was prepared by our resident MLS guru, and my partner, Justin Altman. He can be reached at justin.altman@sothebysrealty.com.

Tornado Housing Market

While reading an article in Barron’s the other day, I came across a concept that I thought perfectly summed up the current market conditions. It makes sense because the president of a major brokerage in New York City coined it a “Tornado Housing Market.”

In Park City, we are firmly in a new market, one that we have not quite seen before. The “Tornado Housing Market” phrase works so well because it refers to the idea that a tornado can rip through a neighborhood and only destroy one or two homes while others can get away somewhat unscathed. In our housing market, you have some homes selling on day one with multiple offers while another house down the street languishes without showings.

We aren’t sure which way the “Tornado” will move or how long it will stick around. Q3 was an interesting quarter for real estate because it was genuinely unpredictable. Still, now that we have entered Q4, I think we can look back, see some significant trends, and mine the data for useful information as we look forward.

Slowdown ≠ Lower Prices

Media outlets have been calling for the catastrophic downfall of the housing market for some time now. And while transactionally, it has been slow, the demise has yet to appear. Overall, it was a slow quarter. Although it was not quite the slowest we have seen ever, it was well off the mark that we have come to expect over the last couple of years.

Let’s get the significant bit out of the way up front – interest rates are one of, if not the most crucial, drivers in a real estate market. There is a strong causal link between interest rates going up and home sales going down. Interest rates have been on a tear for a while, and as they continue to climb, activity slows down. That said, people will always transact because life happens. Just understand that until there is stabilization within the economy and with interest rates, the pace of the market will remain slow.

The second significant bit here – a slowdown in transactional volume is not equivalent to depreciation in pricing. Have prices dropped since their peak? Yes. Are prices still up overall in 2022? Also, yes.

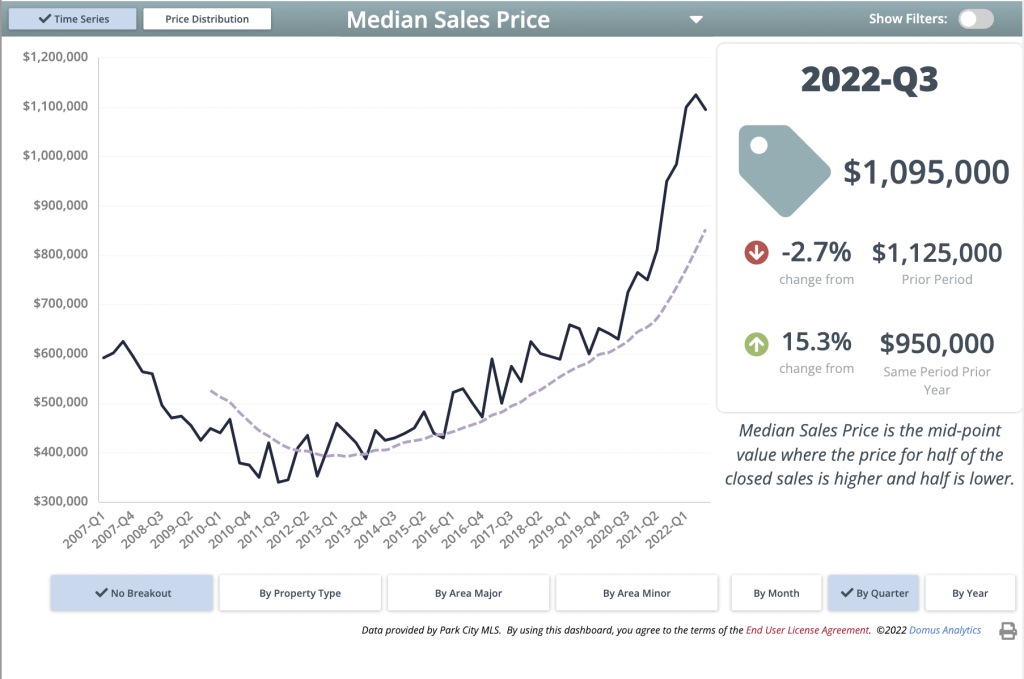

Let’s take a look at the data:

These charts are about our total service area. As you can see, the median price is down 2.7% from Q2, while the average price is down 5.9% from Q2. Putting the slight regression in perspective, you can see that comparable to Q3 of last year, pricing is still up. Even in comparison to Q1 of this year, the regression gets smaller or goes flat in the case of the median price.

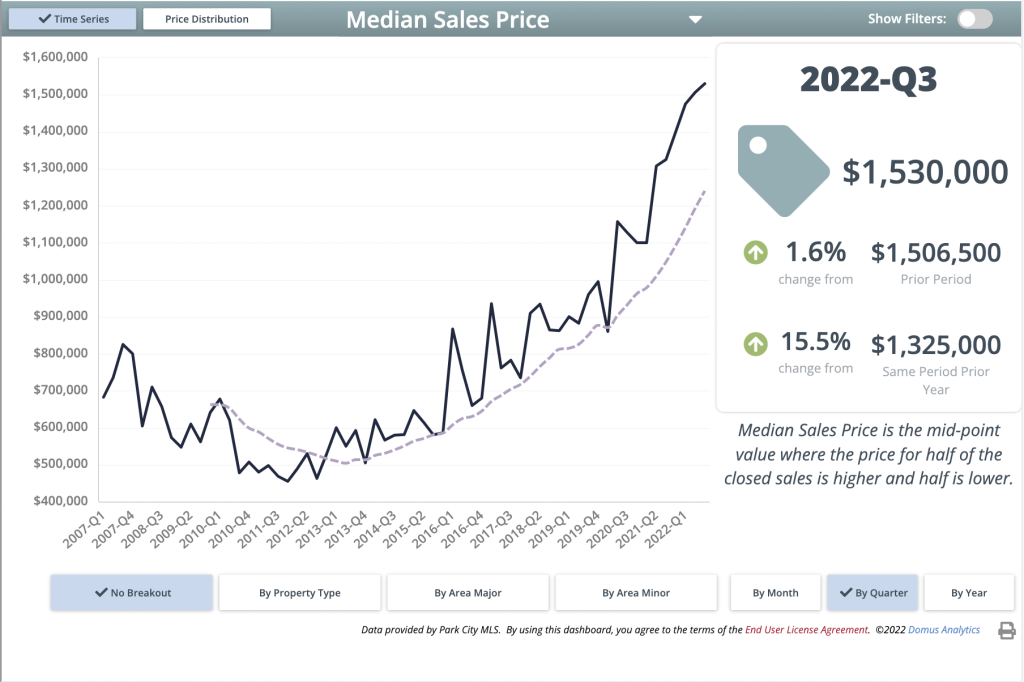

Adjustments in pricing to accommodate time on the market and interest rates likely contribute to these figures. Fortunately, we do not see significant price drops on properties due to sellers being overleveraged. Looking at Greater Park City, we can see that the median price went up!

Interestingly enough, the median is up 1.7% and sets a new high! Meanwhile, the average is still down 7% – both of these tracks with the total service area of the MLS, but I think it does an excellent job illustrating the overall strength of pricing.

Where is Inventory in Park City?

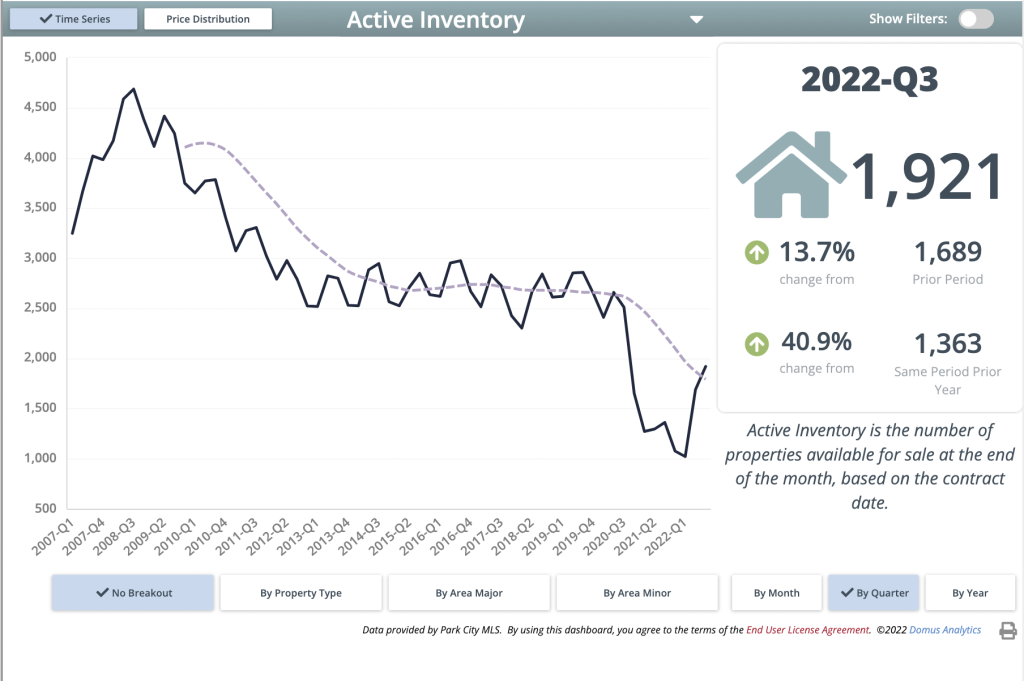

Aiding in price stabilization is a distinct lack of inventory. While some markets across the country are back to pre-covid levels of inventory, our market is still lagging. You can’t have significant price drops if there isn’t inventory to drive pricing down. Simply put, until supply far outpaces demand, pricing pressure will remain strong.

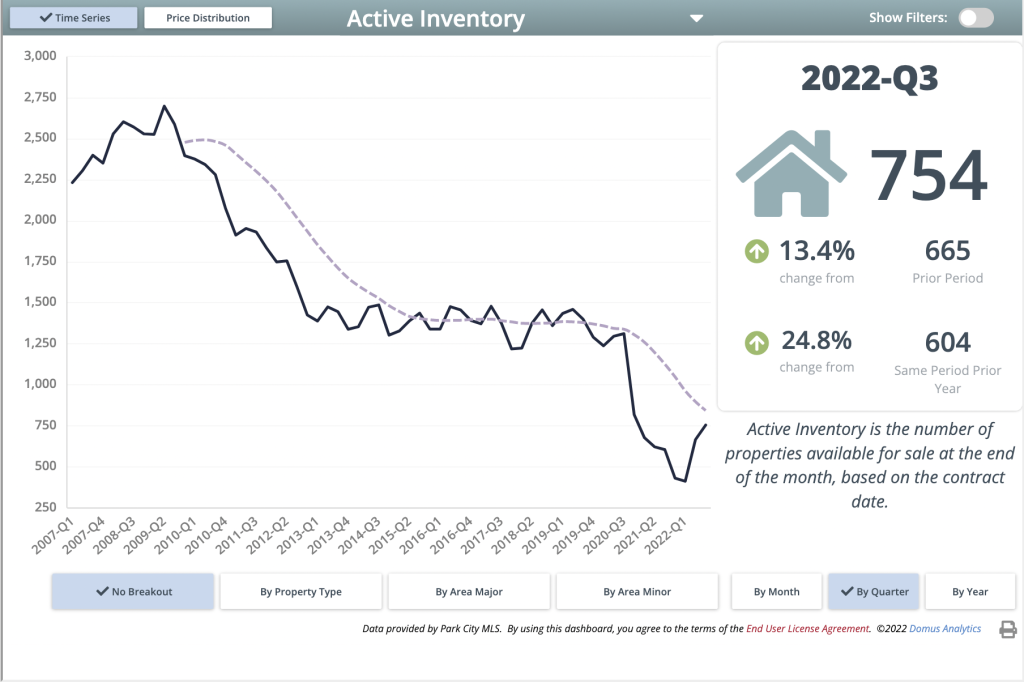

Helping the market were the significant gains in inventory realized over the summer. However, as evidenced above, total inventory levels are at about a 30% deficit. While not as large as the deficit we were previously operating with, it does impact the market from transactional volume to pricing quite a bit. The inventory deficit gets even more significant when we look at the Park City market and remove the outlying areas.

We can see that based on the pre-covid trendline, we are operating at about a 50% inventory deficit. Inventory will continue to be one of the more significant challenges we face in the market, and this lack of inventory will pressure pricing by limiting overall purchasing options for buyers. It will take some time for inventory to level off due to the “locked-in” effect.

Over the last two years, buyers and homeowners have taken advantage of some of the lowest interest rates we have ever seen. Folks with 3% and below fixed rates and considering selling are facing rates that have more than doubled. Even a lateral move now adds financial pressure.

Where is the Market Going?

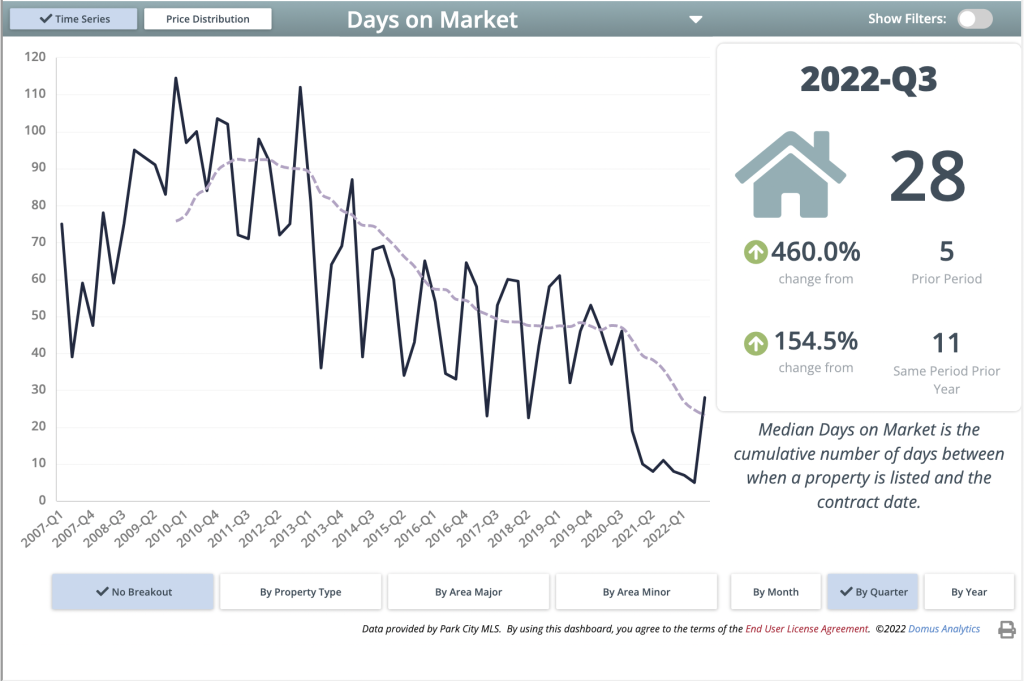

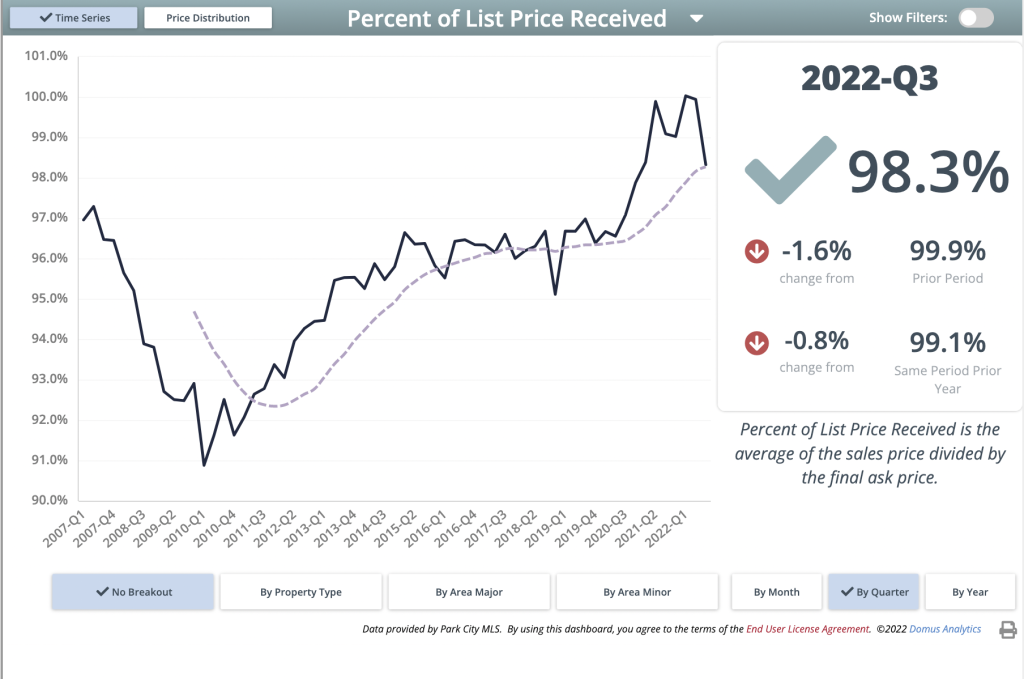

Overall the market is moving at a slower pace, and we all would do well to reacquaint ourselves with how the Park City market used to operate. Below you will see the Average Days On Market and % Of List Price for Q3.

The market is moving towards an equilibrium where buyers have an opportunity to preview properties and take in the market. There is also room to negotiate! From a buyer’s perspective, we are seeing properties spend close to a month on the market and receive about 98.3% of the list price, so this is not bargain hunting – and keep in mind properties that have been renovated, are new construction, have a great floorplan, or have a great location are still in high demand. We have seen properties like that be highly competitive.

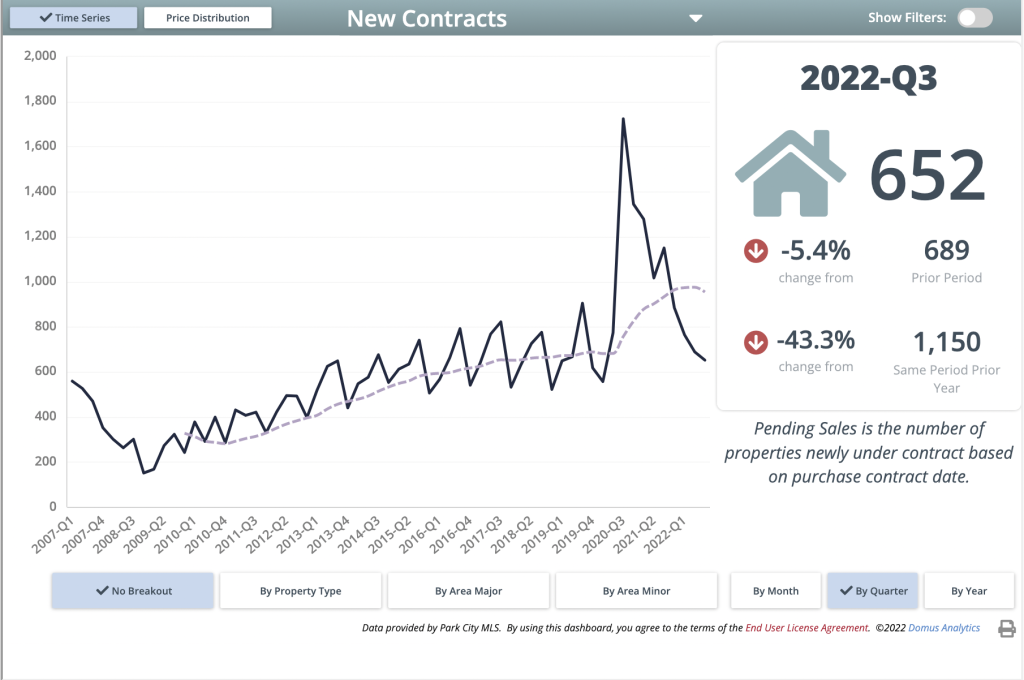

From a seller’s perspective, your property must stand out. Deliberate action is now more valuable than listing your property as soon as possible. That means thoroughly preparing your home, creating a solid marketing plan, crafting a list price that creates a value proposition, and finally, working with someone who is an expert at all of these will generate the greatest return on your investment. We can see below that Q3 buyers and offers were quite limited.

Q3 saw the lowest amount of offers written in a Q3 since 2012! Digging deeper, we can find interest rates as the primary driver. As interest rates dropped in late July/Early August, the number of offers written rose dramatically, nearly doubling over the previous 30-day period.

Good News for Buyers and Sellers

I have a bit of good news for both buyers and sellers. Good options benefit both parties when it comes to reducing the hit of an interest rate. 2-1 rate buydowns and seller-paid permanent rate buydowns are popular right now. These can net sellers higher sales prices while giving buyers significantly lower monthly payments. You can also explore a tax incentive program such as a 1031 exchange, which we wrote about last week.

Additionally, as a buyer, you marry your property, not your rate. Exploring adjustable-rate mortgages and jumbo loans could save you money upfront. You can always refinance at a lower rate when those come down.

The Park City real estate market remains robust. With limited inventory, pricing stability, and high desirability, I would expect to see leveling off and perhaps a quiet Q4. In the long run, though, we have solid fundamentals in place that should help keep the market stable and weather the slowdown in transactional activity.

If you would like to dive a bit deeper into a specific neighborhood, talk about your property, or want to explore the lending options mentioned above, please reach out, and we can schedule a time to review your questions.