This thorough roundup and analysis of Q3 2021 stats was prepared by our resident MLS guru, and my partner, Justin Altman. He can be reached at justin.altman@sothebysrealty.

Welcome to another edition of my Park City quarterly market analysis. I will discuss inventory and affordability, their influence over the market, and the ripple effects they are causing. I also have some interesting takes from a few different economists about what housing prices will bring next year. Finally, I am also compelled to provide a sidebar on the “Zillow situation” and give some needed context and personal takes.

The story of Q3 is that falling inventory coupled with strong buyer demand pushed sales volume down and prices up throughout our market.

Single Family Homes

Park City Proper (84060)

The average and median home prices are up double digits, 14% & 16% from Q3 of 2020. The average price of a home has risen to $3.418m, and the median home price is $2.9m.

- Prospector. Within 84060, there is a fantastic little neighborhood known as Prospector on the south side of Kearns Blvd. I have always believed the community to be a hidden gem, and it was always seen as accessible in terms of price. A year ago, in Q3 of 2020, the average home price was just over $1m. This number has surged in the past year, and the average sale price in Q3 of 2021 is now $1.915m. As folks get priced out of the other neighborhoods in central Park City, they are taking their larger budgets to Prospector.

- Park Meadows. Park Meadows was the model of consistency in terms of appreciation, transactions, and pricing – however, I am officially stripping Park Meadows of that title. As a neighborhood in Q3 of 2021, Park Meadows had 17 home sales – ranging in sale price from $1.385m to $6.5m, which means it is becoming far more difficult to assess values based on numbers alone. Such a wide sale price range in a single neighborhood means that statistical outliers will be ever-present. This is where nuance and context are vital. Still, the average price in Park Meadows comes in at $2.89m, technically LOWER than in Q3 of 2020. However, all it takes is a top-loaded or bottom-loaded quarter to throw those numbers out of line. Therefore, I don’t think that Park Meadows has plateaued in price. We saw a quarter with significant sales under $2m that dragged the average price down. Furthermore, it is not as though the bottom of the market isn’t appreciating; those homes at the lower end of the spectrum also experienced an increase in sales price.

The Snyderville Basin (84098)

This area illustrates the rapid change occurring in our small town. While 84060 has more “modest” YoY increases in average home prices, they don’t even come close to the neighborhoods of Snyderville Basin. Silver Springs had a 74% increase in the average cost of a home compared to Q3 a year ago, moving from $1.196m to $2.08m. Pinebrook jumped as much as 54%, moving homes prices from $1.251m to $1.928m, and Jeremy Ranch skyrocketed 87%, with home prices going from $1.234m to $2.309m. These remarkable price increases show the continued trend of buyers priced out of the “Park City Proper” expanding their search to the Snyderville Basin.

- Promontory. The crown jewel of Park City, of course, is still Promontory. It has one of my favorite pieces of data: YoY units sold are down 35% with 32 sales in Q3 of 2021 compared to 49 sales in Q3 of 2020; however, sales volume is UP 14% courtesy of the average home price moving up an astonishing 71% from $2.5m to $4.299m. This is a perfect demonstration of the theme of low inventory and high buyer demand pushing up prices. Of the 29 Active homes currently listed at Promontory, only 7 are already built. The others will not be move-in ready for 1-2 years.

Gated Golf Club Communities

In the Park City area, there are five golf course communities: Glenwild, Promontory, Tuhaye, Victory Ranch, and Red Ledges. In the last year (Oct 1, 2020 – Sept 30, 2021), these five communities have sold the equivalent of 5 years’ worth of vacant land. The demand for these golf and amenitized communities is overwhelming, yet there are few if any homes available for purchase. This has led some clients to purchase lots to get their foot in the door while waiting for a resale home, or to build a custom home.

Condominiums

Condos continue to follow the same trends as single-family homes across our entire marketplace. We have also noted buyers priced out of single-family homes settling for condominiums.

- 84060. In Old Town, where a good portion of these condos are located, the average price has moved up to $1.065m, a 25% increase over the previous year; Lower Deer Valley increased 75% with a new average price of $2.16m. Even Prospector jumped 64% from $265k to $434k (keep in mind the majority of Prospector’s condos are studio and one-bedroom units.)

Inventory and Affordability

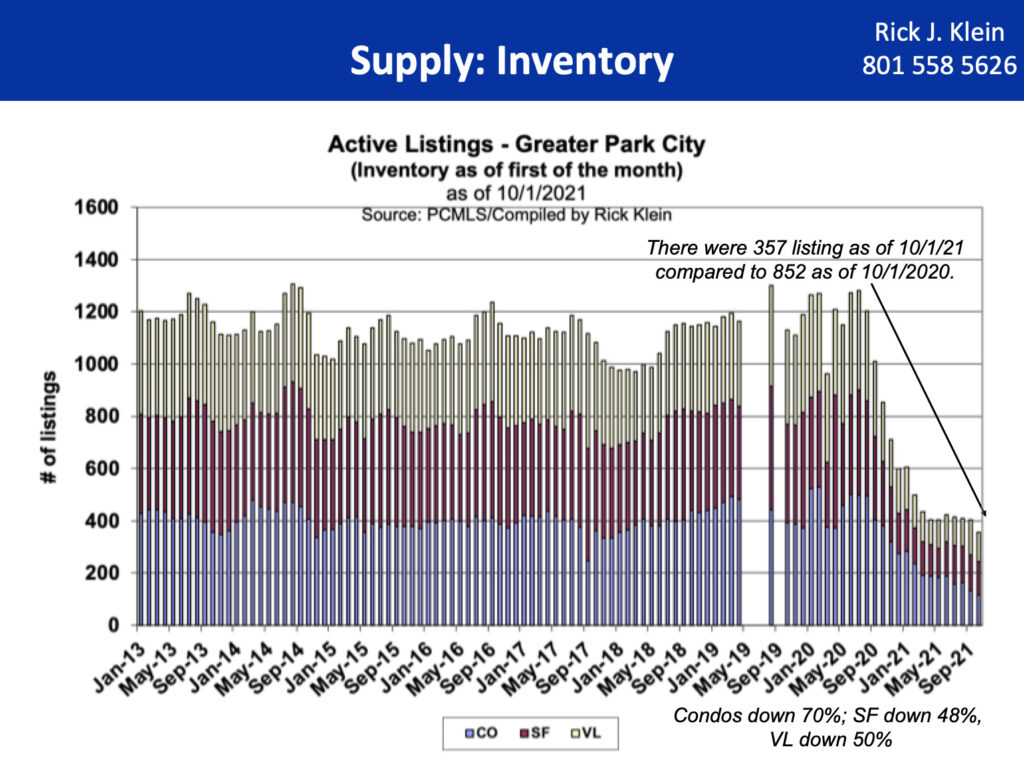

Inventory is probably the single most crucial factor to our market. As of this writing, we have the lowest recorded number of properties on our Multiple Listing Service ever. In May of 2020, we had roughly 2000 properties to choose from across all property types; that number at the end of September was 394. When we talk about regression to the mean, we need to ask what it would take to get back to 2000 properties available on the MLS? The answer to this question guarantees that inventory will continue to be a factor in our market for 2022.

Buyers priced out of both Park City Proper and Snyderville Basin are expanding their search to the periphery areas like the Heber Valley, the Kamas Valley, and the Jordanelle district. For example, condos and townhomes in the Jordanelle district and Hideout have experienced a 100% increase in transaction volume YoY.

As prices continue to climb because of the lack of inventory, a good portion of our residents no longer have the ability to climb the neighborhood ladder, so they are staying put. Even though their property values have gone up, the subsequent neighborhood that they would shoot for has also gone up. The short version is that affordability impacts our inventory because people cannot afford to move up, only out, and why would you leave such a great place? As we can see, you wouldn’t!

While Park City has become more expensive, it is still one of the most “affordable” resort towns in the western United States.

- Aspen median price per square foot: $2,338

- Jackson Hole median price per square foot: $1,100

- Vail median price per square foot: $1,000

- Sun Valley median price per square foot: $758

- Park City median price per square foot: $595

Below are some expert predictions on the future of the housing market in 2022:

- Goldman Sachs predicts a 16% increase

- Zillow predicts an 11% increase

- Freddie Mac predicts a 5.6% increase

- CoreLogic predicts a 2.2% increase

From 2010-19, the Park City market experienced about 6% compound growth.

Zillow and the iBuying Program

Perhaps you have heard that Zillow is shuttering their iBuying program. Zillow shut down their iBuying program because it was grossly unprofitable, losing $1B in just three and a half years. In Q1 of 2021, they were losing nearly $30k per house sold, and by Q2 of 2021, that number was $28k per house sold. Their stock has been sliding ever since its high in Q1 and, just before the announcement, had lost about 50% of its value. Real estate is a complex craft, and algorithms can only get you so far.

If everything before this was Thanksgiving dinner, then this last paragraph is the pecan pie dessert! The housing market in Park City is likely to see a drop in most statistical categories due to the massive shortage of inventory and the seasonality of Q4. However, I would still expect to see the status quo maintained: multiple offers and an aggressive market with limited days on the market. 2022 appears primed to be another strong year, and property in Park City and the surrounding areas continues to be an intelligent choice. As Zillow found out, this is a real estate market where expert guidance is critical. The biggest risk to sellers is leaving money on the table. The biggest risk to buyers is writing offers on several properties and losing out on each one to multiple offers. We have helped over 60 buyers and sellers in 2021 prevail.

As always, please feel free to reach out with questions or if you want a detailed analysis of a specific area. I am always happy to chat numbers with folks and genuinely appreciate your reading.

Sources:

Local Market Data – Park City Board of Realtors

Economic Outlook – A big shoutout to Intercap Lending!

https://www.housingwire.com/articles/goldman-sachs-home-prices-will-rise-another-16-in-22/

https://fortune.com/2021/10/11/zillow-home-prices-forecast-2022-outlook-real-estate-buying-a-house/

Price per Square Foot – Aspen Snowmass Sotheby’s & Realtor.com

https://www.realtor.com/realestateandhomes-search/Jackson-Hole_WY/overview

https://www.realtor.com/realestateandhomes-search/Sun-Valley_ID/overview

https://www.realtor.com/realestateandhomes-search/Vail_CO/overview